Article

citation information:

Krzyżewska, I. Problems in the organisation of the transport process on the international

market. Scientific Journal of Silesian

University of Technology. Series Transport. 2021, 112, 113-123. ISSN: 0209-3324. DOI: https://doi.org/10.20858/sjsutst.2021.112.7.9

Iwona KRZYŻEWSKA[1]

PROBLEMS

IN THE ORGANISATION OF THE TRANSPORT PROCESS ON THE INTERNATIONAL MARKET

Summary. The transport process

consists of many stages, where many interferences and problems may occur. It is

important to identify these problems and find solutions to them, for example,

using innovative tools supporting transport process management. A properly

organised transport process allows the entire supply chain to function

properly. For a transport process to be effective, it must be appropriately

coordinated from planning, organising, implementing and controlling. In each of

these phases, different types of problems may be encountered; therefore, the persons

responsible for the various phases must monitor them closely. By reacting

quickly, they can resolve any interference, so that the whole supply chain runs

without major problems. The organisation of transport processes consists of

several phases, which are an integral part of the whole process. Properly

trained staff, knowledge of the transport market and the needs of the customer

are essential for a company to function properly. Thanks to these three

components, a company can offer services at the highest level. This work aims

to develop a scheme of the transport process on the international market and

also identify problems occurring in the organisation of transport processes.

Some solutions to existing problems are also proposed.

Keywords: transport problem, international market,

transportation rates, empty mileage

1. INTRODUCTION

Road

transport has a major role in the Transport, Shipping and Logistic (TSL) industry due

to its well-developed infrastructure, delivering thousands of tonnes of goods to production and finished products to the

contractor. Freight transport is involved in the entire production and

distribution cycle, delivering goods for production as well as finished goods

to the customer

[1-4]. Each single transport order executed is, in fact, a complex process,

consisting of many elements and stages [5, 6]. Different definitions of a

transportation process can be found in the literature. The transport process is

defined as a sequence of consecutive activities, constituting a certain whole,

as a result of which goods will be delivered to the customer in the most

efficient way. The following components can be distinguished in the transport

process: movement, administrative, legal, financial, organisational

and economic activities [7, 8]. In real conditions, the whole transport process

depends on many people for documentation transfer, realisation

of loading and unloading, driver's working time, and monitoring of the whole

transport course. At subsequent stages, there are interferences and problems on

which depends the quality and possibility of realisation

of a particular order. Therefore, it is important to identify these

interferences and propose solutions that will improve the quality of transport

order execution [8]. This work aims to develop a scheme of the transport

process and to identify problems occurring in the organisation

of transport processes on the international market. Some solutions to existing

problems are also proposed.

2. MATERIALS

AND METHOD

Observation of the organisation of the

transport process and identification of problems in the investigated company

were made. The examined transport and forwarding company is a small company

with a fleet of 20 trucks, based in Tychy, Silesia, southern Poland.

In the organisation of the transport process,

various types of interference that negatively impact the company can be

identified. A process map (scheme) was made in the investigated company. On the

other hand, the identification of the most important problems that mostly

influence the organisation of transport on the

international market was made in the examined company. To emphasise

and confirm the significance of the occurring problems in the organisation of transport on the international market, a questionnaire

survey was conducted among the owners of transport companies, forwarders and

professional drivers. An average data analysis was developed based on the

number of indications from 50 survey questionnaires.

3. RESULTS

3.1. Organisation of

transport process

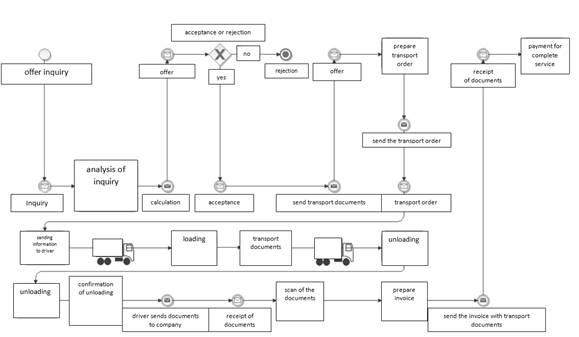

In Figure 1, the transportation process from the moment of sending the

request for offer, to the moment of payment for the service, occurring in

reality in the transportation company is presented. The method is presented in

a graphical form, providing answers to which processes are interrelated.

Every day, a transport company receives many enquiries in the mailbox

about the possibility of realisation transport. To

respond to the enquiry, the forwarder checks the transport possibilities and

transportation rates.

The most critical stage is the flow of transport documents. After

unloading, the driver sends the transport documents by post or by scan to an

email. Nowadays, an increasing number of companies opt for a safer, faster way

of receiving documents electronically. This makes it much easier for carriers

and clients, as they do not have to wait to receive the original documents. By

accepting the documents electronically, the payment period is significantly

reduced and is thus, as many days as the agreed payment period.

Fig. 1. Transport process (author’s

study)

3.2. Problems identification in the transport

process

The following paragraphs describe the results of a survey of drivers,

forwarders and transport company owners on the problems they experienced in the

organisation of the transport process on the

international market.

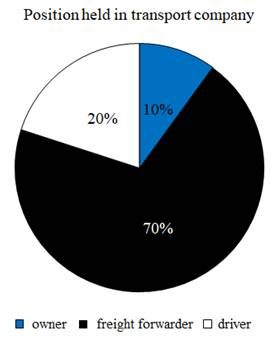

Figure 2 shows that most of the respondents work as freight forwarders

in a transport company (70%), 20% of the answers were given by drivers, and

only 10% by the owners of the transport companies.

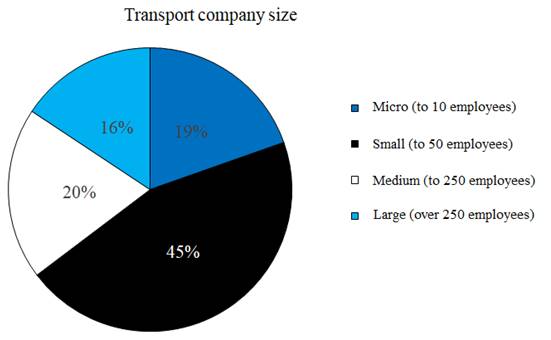

Figure 3 depicts that most of the respondents (45%) work in small

companies that employ up to 50 people. The smallest number of respondents (16%)

work in large companies that employ over 250 people. Only 19% of respondents

work in micro-enterprises, which employ up to 10 people, and in medium

enterprises that employ up to 250 people, it is 20% of the total number of

participants in the survey.

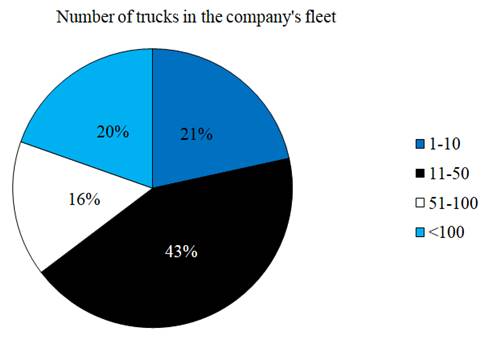

Figure 4 reveals that the highest number of sets of vehicles owned by

the enterprise where the respondents work, is between 11-50 trucks (43%). The

smallest value is between 51 and 100 sets of vehicles (16% of respondents).

Fig. 2. Position held in transport company

(author’s study)

Fig. 3. Transport company size (author’s study)

Fig. 4. Number of trucks in the company’s fleet (author’s

study)

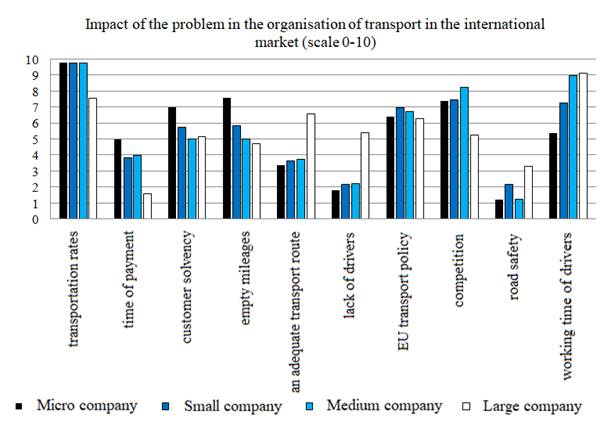

From the results presented (Figure 5), one can conclude that transport

rates contribute mostly to the way a company operates, while road safety has

the least influence. Different opinions may result, among others, from

different working systems of a given company, for example, a signed contract

for a fixed relationship, where the owner of the company does not have to worry

about the payment term, because he has the same payment term in the contract

for all transport orders and about empty runs as well, as loading/unloading

takes place at the same company (at the same place).

Additional problems mentioned by respondents in the organisation

of the transport process are listed in Table 1.

Tab. 1

Additional

problems in the organisation of the transport process

|

Company size |

Problems |

|

Owners |

|

|

Micro |

·

IT systems (old,

lack) ·

lack of parking

spaces |

|

Small |

·

lack of

sufficient, safe and secure parking areas |

|

Medium |

·

lack of

sufficient, safe and secure parking areas |

|

Freight forwarders |

|

|

Micro |

·

lack of

sufficient, safe and secure parking areas |

|

Small |

·

unreasonable

retention of trucks loading/unloading places ·

lack of

sufficient, safe and secure parking areas |

|

Medium |

·

lack of

sufficient, safe and secure parking areas |

|

Large |

·

lack of

sufficient, safe and secure parking areas ·

lack of drivers |

|

Drivers |

|

|

Micro |

·

lack of parking

spacer |

|

Small |

·

lack of parking

spacer ·

unreasonable

retention of trucks loading/unloading places ·

low salary |

|

Medium |

·

lack of parking

spacer ·

theft of foods |

|

Large |

·

lack of parking

spacer |

Fig. 5. Impact of the problem on the organisation

of transport on the international market (scale 0-10) (author’s study)

Different types of interferences, which negatively affects the company,

can be identified in the organisation of the

transport process.

The following most important problems were identified during the organisation of the transport process:

Transportation rates

It often occurs that the proposed rate per 1 km loaded is too low to realise the transport order at a high level. However, there

is the risk of contacting another company with a

lower rate for the same service if the rate proposed by the carrier is too

high.

Delays due to waiting for loading/unloading

Transport orders have routes where the unloading place is many kilometres away from the next popular loading places. In

such a situation, it is necessary to increase the freight rate, including

vehicle drive to the next place of loading. However, in many cases, this

results in a rejection by the customer.

Non-payment for freight or delayed payment for

completed service

The payment term agreed upon in

the terms of service is calculated from the date of receipt of all transport

documents and invoice. The driver is scheduled to carry out orders on the road

for about 3 weeks. After this period of time, it is possible to receive the

documents from the fulfilment of orders by the driver and the specific vehicle.

Waiting for the documents to flow and for the driver to return to the base extends

the payment period by several days.

Working time of drivers

Often, the limitation in the

implementation of transport is the working time of drivers and the applicable

standards and legislation. On 15 July 2020, Regulation (EC) No. 561/2006 and (EU)

165/2014 were amended regarding, among other things, the guarantee of the

return of the driver by the company, every maximum of four weeks to the

driver's place of residence or the company’s registered office. The

driver should take a regular weekly rest of 45 hours after a maximum of 6 daily

driving periods. This period may be shortened, no more than twice in two weeks

in a row to 24 hours, provided the next rest is regular and compensation is

received for the two previous shortened rests. A regular rest must be taken at

the driver's place of residence or business. A driver may not take a regular

rest of 45 hours in a cockpit. The employer must provide the employee with an

overnight stay outside the cabin. In addition, the new regulation allows extending

the driving time by a maximum of 2 hours when returning to the depot, but the

driver must document the reason for the extended driving time on the tachograph

printout. After an extension of driving time, the driver must take at least

nine hours of daily rest and compensation for the extended driving time [9, 10].

3.3. Problem solutions in the organisation

of the transport process

To be able to improve the organisation of the

transport process in the international carriage of goods, the company should,

among other things:

1) Implement a

vehicle monitoring system,

2) Optimise transport routes,

3) Verify

potential customers,

4) Vindicate

clients who are in delay with payments,

5) Negotiate

transport rates to waiting time for loading and unloading.

1) Monitoring system of vehicles

In the logistics market, many companies offer vehicle monitoring system.

The main function of this system is its ability to monitor a vehicle around the

clock in real-time. However, most systems offered by various companies have

additional services which, for example, prevent the stealing of goods, by

the driver requesting help by pressing a button and sending information about

an accident. Many other companies offer similar systems. It is worth

considering and consulting other specialists (forwarders, logisticians,

planners) who have daily contact with the presented systems to choose the most

suitable one for a company.

2) Optimisation of the transport route

Empty mileage is a problem for most transport companies. It is rare for

unloading and loading to take place at or near the same warehouse. However,

there are tools to minimise empty mileage. Such tools

are the freight exchanges. The main freight exchanges in the TSL sector are :

-

TimoCom,

-

Trans.eu,

-

Teleroute.

Table 2 below compares freight exchange.

Tab. 2

Freight Exchange [12-14]

|

|

TimoCom |

Trans.eu |

Teleroute |

|

Founding year |

1997 |

2004 |

1987 |

|

Number of daily offers on the Exchange |

About 550000 |

About 150000 |

About 20000 |

|

Offered directions |

Germany, Italy, Austria, Czech Republic, Slovakia, Netherlands,

Belgium, Spain, France, Portugal, United Kingdom, Switzerland, Denmark,

Norway, Lithuania |

Mainly loads within the country or departures from the country.

However, there are also offers for Germany, Italy, Belgium, Holland,

Spain |

Mainly France, Belgium, Netherlands, Luxembourg |

|

Free trial period |

1 month |

1 month |

free software demo |

|

Cost of Rusing |

The cost depends on the needs of the company, the number of forwarders

using the exchange |

100 euro |

The cost depends on the needs of the company, the number of forwarders

using the exchange |

|

Additional

services |

·

Debt collection, ·

Tenders, ·

Warehouse search

engine, ·

Possibility to

connect GPS to Timocom and provide vehicle tracking

to customers, ·

Travel cost

calculator, ·

Transport

barometer |

·

Debt collection, ·

The possibility

of connecting GPS to Trans.eu and making the vehicle tracking available to

customers, ·

Quick Pay -

quick payment for transport, commission of 1.99% from the freight |

·

Debt collection, ·

Travel cost

calculator, ·

Sending SMS with

loading/unloading addresses to drivers |

|

Termination conditions |

3 months |

1 month |

3 months |

Comparing these 3 freight exchanges with each other exposed some

discrepancies. The most important difference is the destinations offered in the

freight exchange. Of the three freight exchanges, TimoCom

seems to be the best solution as it offers the most freight per day. However,

buying at least two freight exchanges for a better exploration of choices

should be considered. With the free trial, companies can test the practical

differences between TimoCom and Trans.eu. The manner

of contact with potential customers is also a difference between these

exchanges. To enquire about offers in TimoCom's and Teleroute's exchange, customers have to send an email or

make a phone call. TimoCom has a business messenger,

which, however, is usually not used by companies, whereas Trans.eu has a

business messenger as the main form of contact and this makes it much easier to

discuss offers. To optimise the transport route, the

company may additionally use maps dedicated to trucks, which show, among

others:

-

height, tonnage,

width restrictions,

-

driving

prohibitions,

-

real-time roadway

incidents,

-

transport costs.

Such a map can be, for example, HOGS maps or

the Scania Fleet Management System

[11, 15]. With the ability to calculate transport costs, the company can save

up several hundred euros per route, and avoid additional kilometres

that a vehicle can travel without proper directions to the place of

loading/unloading, for example, when it is limited by tonnage bans.

3) Verification

of potential customers

To minimise the

problem of insolvent contractors, companies should verify potential customers.

It is very important to check how long the company has been operating in the

transport market. There are quite a few methods to verify a potential customer,

among others, through:

·

Central Register

and Information on Economic Activity (CEIDG) - a

database of sole proprietor companies. Here, one can check tax number, edit the

entry, whether the company was suspended or is active,

·

KRS - online

database - a register where the civil law relationships between partners can be

checked,

·

National Debtors

Register - a paid register where the current debts and the history of

receivables of a given company can be assessed,

·

European

Commission VIES - tax numbers of contractors from the entire European Union can

be confirmed on this platform.

The freight and vehicle exchanges, TimoCom and Trans.eu, both have the option for customers to

leave their reviews. This is a tool to verify customers.

4) Debt collection

Quite a few companies on the market offer debt collection services. It

is worth making a contract with one of them. These companies first try to

resolve the matter by sending a letter about an unpaid invoice. However, when

the counterparty does not respond to this letter, then they take the matter to

court. Debt collection companies have legal advisers in their teams who prepare

the official letter to the court and handle the case further.

5) Negotiate transport rates in terms of

waiting time for loading and unloading.

Most contractors in the contract of a carriage include a stop on

loading/unloading up to 24 hours for free. When negotiating rates, it is worth

negotiating the terms of parking a car as well. In the terms of order or

contract, one may find the following clause: 100 euros payable for a stopover 5

h to 10 h, over 10 h to 24 h - payable 200 euros.

4. CONCLUSION

The analysis made it possible to characterise

the interferences occurring in the company. The distortions that were presented

affect many transportation companies with varying probability and scale of

potential impact. The interferences observed include transportation rates,

empty mileage, payment terms for contractors and financial terms. To eliminate

these distortions, it was suggested to introduce innovative IT tools such as

the GPS telematics system that allows detecting the location of a truck per

time, helps the forwarder to manage the fleet and the drivers, and special maps

that assist the company in reducing the costs of tolls, save the drivers time

in reaching their destination by being able to check occurring restrictions on

the roads. Several methods were further proposed for the verification of a

potential contractor, as well as the agreement with a debt collection company

in terms of non-payment for the transport service by a customer. All

abovementioned work to reduce additional costs incurred by the company,

increase work efficiency, as well as reduce the occurrence of risks in the

future.

References

1.

Hajdul M., M. Stajniak, M. Foltyński, A. Koliński,

P. Andrzejczyk. 2015. Organization and monitoring of transport processes. Poznan:

Publishing Institute of Logistics and Warehousing.

2.

Ambroziak T., D. Pyza. 2008.

„Selected aspects of transportation system modelling”. Total Logistic Management: 15-24.

3.

Nowakowski T. 2012. „Problems of Transportation Process

Reliability Modelling”. Economic

studies, Developing of transportation flows in 21st century supply chains 121: 113-132.

4.

Kacperczyk J. 2021. „Modes of transport. Part 1”.

Warsaw: Publishing Difin SA.

5.

Golebiowski Piotr, Marianna Jacyna, Jolanta Zak. 2019. “Multi-criteria method of

selection the way of conducting railway traffic on the open line for modernized

and revitalized railway lines”. In: 2nd

International Scientific and Practical Conference on Energy-Optimal Technologies,

Logistic and Safety on Transport (EOT). Lviv, Ukraine. September 19-20, 2019. MATEC Web of Conferences 294. Article number: 04015. 2019.

6.

Izdebski Mariusz, Marianna Jacyna, Piotr Klimek, Ilona Jacyna-Golda, Rostislav Vasek. 2019. “Decision-making problems of designing

database in the aspect of planning transport of cargoes by intermodal

transport”. In: 2nd International

Scientific and Practical Conference on Energy-Optimal Technologies, Logistic

and Safety on Transport (EOT). Lviv, Ukraine. September 19-20, 2019. MATEC Web of Conferences 294. Article number: 04015. 2019.

7.

Neider J. 2008. „International transport”.

Warsaw: Polish Economic Publishing.

8.

Wiszniewska M. 2008. „Carriage of cargo. A.28 Organization and supervision of transport 1. Planning

of transport processes realization”. Warsaw: Publishing Difin SA.

9.

Regulation (EC) No

561/2006 of the European Parliament and of the Council of 15 March 2006 on

the harmonisation of certain social legislation

relating to road transport and amending Council Regulations (EEC) No 3821/85

and (EC) No 2135/98 and repealing Council Regulation (EEC) No 3820/85.

10. Regulation (EU) 2020/1054 of the European Parliament

and of the Council of 15 July 2020 amending Regulation (EC) No 561/2006 as

regards minimum requirements on maximum daily and weekly driving times, minimum

breaks and daily and weekly rest periods and Regulation (EU) No 165/2014 as

regards positioning by means of tachographs

11.

Hogs Maps – New generation of maps for trucks.

Available at: https://hogs.live/.

12. TimoCom – Management of transport process. Available

at: https://www.timocom.pl/.

13. Trans.eu –

Logistics platform. Available at: https://www.trans.eu/pl/.

14. Teleroute – freight exchange. Available at:

https://teleroute.com/pl.

15.

Management of transport fleet tool – Scania

Fleet Management. Available at: https://fmpnextgen.scania.com/.

Received 11.03.2021; accepted in revised form 20.06.2021

![]()

Scientific

Journal of Silesian University of Technology. Series Transport is licensed

under a Creative Commons Attribution 4.0 International License