Article

citation information:

Opoka, K. Predicting economic indices of

vehicle insurance using the “grey-system theory”. Scientific Journal of Silesian University of

Technology. Series Transport. 2020, 107, 119-133. ISSN: 0209-3324. DOI: https://doi.org/10.20858/sjsutst.2020.107.9.

Kazimierz OPOKA[1]

PREDICTING

ECONOMIC INDICES OF VEHICLE INSURANCE USING THE “GREY-SYSTEM

THEORY”

Summary. This paper contains a prognosis of vehicle insurance

economic indices using the Grey System Theory. It has been prepared based on

data provided by a certain insurance company. The following economic factors

were analysed: number of insured vehicles, premiums income, amount of damage

cases covered, and value of paid compensations. The results of this study

indicate a reduction in all analysed indices over twelve months.

Keywords: transport, grey-system theory, insurance

1. INTRODUCTION

Continuous

increase in vehicle use all over the world, including Poland, is accordingly

followed by rapid growth in the number of road accidents [1-3]. These result in

injuries among not only car users, but also other public road users, for

example, pedestrians, cyclists, etc. Despite a thorough and constantly

improving prevention policy, road accidents cannot be eliminated, thus emphasis

should be put on mitigating their consequences, among others, by enforcing

better legislation that is critical for higher safety on public roads [4-5].

The most important regulations that affect safety on public roads, and in

particular, protect the casualties of road accidents include the proper

formulation of rules regarding civil liability for car accidents and effective

insurance.

The

concept of vehicle insurance refers to all types of insurance regarding motor

vehicles. These include [6]:

·

mandatory civil liability insurance of motor vehicle users, governed by

the Act of 22 May 2003 on compulsory insurance, the Insurance Guarantee Fund

and Polish Motor Insurers' Bureau,

·

other voluntary vehicle insurance including vehicle damage consequences

and theft insurance (referred to as the “autocasco insurance” in

Poland), all-accidents insurance of driver and passengers.

Currently, 56 notified insurance

companies operate in Poland.

Since the major economic indices of the insurance industry are the

income on the sale of insurance policies and the amount of paid compensations,

this analysis shall predict the following indices:

·

number of insured vehicles,

·

premium income,

·

number of damage cases covered,

·

value of paid compensations.

The

input parameters of the prognosis were the data provided by a certain insurance

company operating in Poland. These data concerned the period from 2018 to 2019

and the prognosis concerned the following 12 months.

2. DISTRICT INFRASTRUCTURE AND VEHICLE ACCIDENTS RATES

Road accidents are

categorised as random events. However, it must be pointed out that their

quantity and severity are certainly determined by terrain conditions, including

road infrastructure, as well as the number of vehicles in traffic.

2.1. Geographical situation, classification and number of

communication routes

Nowy

Sącz district is situated in the southeastern part of the Małopolskie

Voivodeship. On the south, it borders with Slovakia (state border), on the east

with Gorlice district, on the north with Tarnów and Brzesko district and

on the west with Limanowa and Nowy Targ district. The total area of the

district is 1550.11 km2. Mountains and uplands, as well as the

valleys of the Dunajec River and its main tributaries: Poprad and Kamienica,

cover most of the area. These rivers separate the major mountain ranges of the

Nowy Sącz region: Beskid Sądecki, Low Beskids and Island Beskids

surrounding the Sądecka Valley, the largest settlement area of the region.

The major towns of the district are Nowy Sącz (capital), Stary Sącz

and Grybów. Other known towns and spa communes include Krynica, Muszyna

and Piwniczna. There are also smaller communes and villages, including

Podegrodzie, Łącko, Chełmiec, Nawojowa, Korzenna, Kamionka

Wielka, Rytro and Łososina Dolna.

Tab.

1 presents the classification, number and lengths of major roads approved for

wheeled traffic in the district.

Tab. 1

Classification, number and lengths of roads

|

Road category |

Number of roads |

Road length [km] |

|

State |

3 |

96.9 |

|

Regional |

4 |

118.2 |

|

District |

80 |

5.0 |

2.2. Summary of registered vehicles

Tab.

2 presents a summary of vehicles registered in the Nowy Sącz district as

at 31 December 2018 and 30 November 2019.

Tab.

2

Summary of vehicles registered from 2009 to 2018 [7]

|

Years |

Motor vehicles |

Vehicle categories |

||||||

|

Cars |

Lorries |

Motorcycles |

||||||

|

Total |

2009=100% |

Total |

2009=100% |

Total |

2009=100% |

Total |

2009=100% |

|

|

2009 |

22,024,697 |

100.0 |

16,494,650 |

100.0 |

2,595,485 |

100.0 |

974,906 |

100.0 |

|

2010 |

23,037,149 |

104.6 |

17,239,800 |

104.5 |

2,767,035 |

106.6 |

1,013,014 |

103.9 |

|

2011 |

24,189,370 |

109.8 |

18,125,490 |

109.9 |

2,892,064 |

111.4 |

1,069,195 |

109.7 |

|

2012 |

24,875,717 |

112.9 |

18,744,412 |

113.6 |

2,920,779 |

112.5 |

1,107,260 |

113.6 |

|

2013 |

25,683,575 |

116.6 |

19,389,446 |

117.5 |

2,962,064 |

114.1 |

1,153,169 |

118.3 |

|

2014 |

26,472,274 |

120.2 |

20,003,863 |

121.3 |

3,037,427 |

117.0 |

1,189,527 |

122.0 |

|

2015 |

27,409,106 |

124.4 |

20,723,423 |

125.6 |

3,098,376 |

119.4 |

1,272,333 |

130.5 |

|

2016 |

28,601,037 |

129.9 |

21,675,388 |

131.4 |

3,179,655 |

122.5 |

1,355,625 |

139.1 |

|

2017 |

29,149,178 |

132.3 |

22,109,572 |

134.0 |

3,212,690 |

123.8 |

1,398,609 |

143.5 |

|

2018 |

29,656,238 |

134.6 |

22,514,074 |

136.5 |

3,249,961 |

125.2 |

1,428,299 |

146.5 |

The

table above indicates that the number of vehicles registered in Poland grows

dynamically. This increase is apparent on the roads and streets.

Due

to the tourist value of the Nowy Sącz region, as well as the multitude of

transport companies operating in the area, road traffic is very intense.

Considering the hilly road configuration, with many sharp bends and slopes,

particular caution is needed when driving across the region, irrespective of

the season of the year or time of the day, with a special concern for weather

conditions.

2.3. Road accidents and collisions as at 31 December 2018

An

accident is an unfortunate random event in which participants die, suffer from

health impairment or material damage. Road incidents are divided into road

collisions and road accidents.

Classification

of road incident in one of the mentioned categories depends on the type of

injury of participants and is specified in the Polish Code of Offences (Art.

156 Sections 1, 2, 3, Art. 157 Sections 1, 2, Art. 177 Section 1).

These

regulations provide the following definitions:

·

collision – event in which no injury occurs or that results in

injuries diagnosed by an authorised doctor, lasting no longer than 7 days,

·

accident – event in which participants die or suffer health

impairment diagnosed by an authorised doctor, lasting longer than 7 days.

Available

statistics published by the National Road Safety Board gave the following main reasons

for occurrence of road incidents in 2019:

·

failure to yield the right of way,

·

inappropriate speed in particular traffic conditions,

·

failure to yield the right of way at a pedestrian crossing,

·

failure to keep a safe distance between vehicles,

·

improper passing.

The

most dangerous roads in the Nowy Sącz district were:

·

national road No. 75 (route from Witowice to Krynica),

·

national road No. 28 (route from Wysokie to Ropska Góra),

·

regional road No. 971 (route from Krynica to Piwniczna),

·

national road No. 87 (route from Nowy Sącz to Piwniczna),

·

regional road No. 969 (route from Zabrzeż to Nowy Sącz).

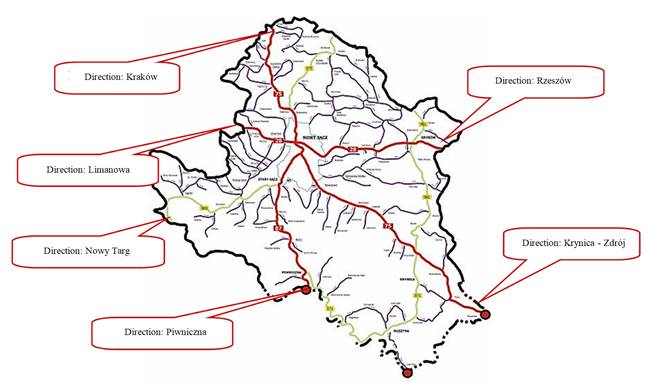

These

routes are presented in Fig. 1. Fig. 2 presents the trend in road accidents

occurrence, while the number of fatal casualties from 2009 to 2018 is shown in

Fig. 3.

Comparing the data

contained in Tab. 2 representing a significant increase in the number of

registered vehicles with the road accident rates illustrated in the diagrams,

it can be concluded that there is an apparent drop in the number of accidents,

including fatal accidents.

2.3. Compulsory vehicle insurance

The

vehicle insurance sector has been developing in Poland after World War II. An

indispensable part of the state reconstruction was the rapid growth of

mobility. This process and related occurrence of accidents due to the

ever-increasing number of vehicles were followed by a significant increase in

the rate of material (vehicles) and personal damage (bodily injury, health

impairment, death) among public roads users. Compensation usually was beyond the

capabilities of the owners and drivers of motor vehicles, thus casualties

incurred significant and irreversible material losses.

Fig. 1. Nowy

Sącz district – most dangerous routes

Fig. 2. Road accidents

occurrence trend from 2009 to 2018 year [7]

Fig. 3. Road accidents fatal

casualties trend from 2009 to 2018 year [7]

To

secure accident casualties against damage, the Act of 2 December 1958 on

property and personal insurance (Journal of Laws No. 72, item 357, Art. 5, as

amended) introduced two types of compulsory insurance:

·

civil liability insurance of owners and drivers of motor vehicles

against damage caused in traffic,

·

insurance against all accidents to passengers or other casualties in

motor vehicle traffic.

Over

the years, compulsory vehicle insurance rules have been updated and revised.

Currently, it is governed by the Act of 22 May 2003 on compulsory insurance,

the Insurance Guarantee Fund and Polish Motor Insurers' Bureau. According to

Art. 23 thereof, the owner of a motor vehicle is obliged to sign a compulsory

liability insurance agreement covering damage caused in relation to

participation in traffic.

Damage

occurs as a consequence of random events. The general legal definition of

“damage” says that it consists of a breach of legally protected

property and interest, which can only be repaired if other liability

requirements are fulfilled. Additionally, damage entails any material or

non-material losses.

In

the analysed period, the insurance company participating in the study

registered 15,458 damage cases.

3. GREY SYSTEM THEORY

The

Grey System Theory was developed in the early 1980s. The concept refers to an

operational condition of an item, in which a certain amount (part) of data

describing a given parameter is known (that is, is clearly defined), while the

other part is unknown. The “Grey System Theory” method uses the

known part of information to determine (predict) the unknown part. The

character of the system is controlled in advance to shape its future

development. The Grey System Theory is used in forecasting events in

economics and agriculture. It was originally used for machine health monitoring

and troubleshooting. This prediction theory works mainly with past data to

create a mathematical model simulating time cycle data. If the required

measurement accuracy cannot be obtained, it is compensated and rectified by

identifying the “remaining data” until proper prediction results

are reached.

The

Grey System Theory has been applied in many fields of science and life. Wang et

al. (2020), used this method to predict the municipal demand for heat

production [8]. The authors of [9] predicted highway traffic intensity, while authors

of [10] dealt with time series prediction applied to road traffic safety in

Germany. The Grey System Theory has been applied in the health care sector

[11], in surface engineering to predict pitting fatigue [12], and also in

logistics, to support freight delivery related decisions [13] or in prediction

of diagnostic symptom values [14].

The

model of grey system is described with the following differential equation:

![]() (1)

(1)

Parameters

“a” and “u” can be calculated by determining the X1(k) model, previously

denoted as the sum of input values of X0(t) models for

i=l,2,...,k.

![]() (2)

(2)

The Grey System Model

derives from the obtained data. Then, the answer or predictive equation has the

following form:

![]() (3)

(3)

Parameters

“a” and “u” can be calculated using the following

equation:

![]()

according to the least

squares method:

![]() (4)

(4)

where B is the following

data matrix:

(5)

(5)

![]() (6)

(6)

If

the required model accuracy cannot be reached, it is compensated and rectified

by identifying the “remaining data” of the model.

The

following data strings will be determined using Equation 3:

![]()

Predicted data are

calculated in the following way:

![]()

![]() (7)

(7)

The rest of the cycle is

calculated using the following equation:

![]() (8)

(8)

k=1,2,...,n

Having

calculated the rest of the cycle![]() ,

other predicted values can be obtained using Equation 3. Next, the values of

the remaining part of the prognosis should be added to the results of

prediction X(0)(k). This process can be repeated as many times as

required until model accuracy is reached.

,

other predicted values can be obtained using Equation 3. Next, the values of

the remaining part of the prognosis should be added to the results of

prediction X(0)(k). This process can be repeated as many times as

required until model accuracy is reached.

The

accuracy of the described method is determined using the following equation,

referred to as “remaining data”:

![]() (9)

(9)

where q(k) is the rest

of k data.

The

average value of real data X0(k) is denoted in the following form:

![]() , k=1,2,...,n (10)

, k=1,2,...,n (10)

The average value of the

“remaining data” q(k) is denoted in the following form:

![]() ,

, ![]() , k=1,2,...,n (11)

, k=1,2,...,n (11)

The variance of real

(measured) values S:

![]() (12)

(12)

The variance of the

“remaining data” S:

![]() (13)

(13)

The quotient of these

two values:

![]() (14)

(14)

is referred to as the

discrepancy quotient.

Calculated values C (Tab. 3) correspond to the lowest error probability

values P:

![]() (15)

(15)

which is equivalent to

classification of the prognosis in a proper accuracy group.

Tab. 3

Method accuracy prediction

|

Prognosis accuracy |

P |

C |

|

good |

>0.95 |

<0.35 |

|

satisfactory |

0.8-0.9 |

0.35-0.5 |

|

unsatisfactory |

0.7-0.8 |

0.5-0.65 |

|

poor |

<0.7 |

>0.65 |

In the analysed sample

predictions based on the “Grey System Theory”, predicted and actual

data (obtained in measurements) are quite consistent. The Grey System Theory

can be used in technical facilities condition inspections as one of the

monitoring system elements.

4. PREDICTING ECONOMIC INDICES IN VEHICLE INSURANCE

4.1. Presentation of processed data

As earlier mentioned in

the introduction section, the prognosis was prepared using statistical data

recorded by a certain insurance company operating in Poland, at the end of each

four-month settlement period in 2018 and 2019. Fig. 4 presents the insurance

economic indices included in the described prognosis.

Fig. 4. Scheme

of predicted insurance economic indices

·

Package policies - provide comprehensive coverage of the vehicle and its

owner and include compulsory liability insurance, voluntary all-accident

insurance with Assistance insurance (technical support and medical aid in

Poland), post-accident coverage for driver and passengers. Offered to owners of

cars, vans and goods vehicles with gross vehicle weight up to 2 [t] in the

analysed insurance company.

·

Other policies - including all-accident insurance.

·

Number of insured vehicles - number of insurance agreements registered

in the analysed period.

·

Premium income - amount earned on the sale of insurance policies in the

analysed period.

·

Amount of compensation - amount of benefits paid in the analysed period.

·

Number of damage cases covered - number of damage cases compensated in

the analysed period.

Tab.

4 contains a summary of the input data needed by insurance companies for

qualitative and quantitative prediction of road accidents.

Tab.

4

Summary of input data

|

No. |

Period of analysis |

Number of insured vehicles |

Premium income [PLN] |

Number of damage cases

covered |

Amount of compensation

[PLN] |

|

Vehicles with package insurance

policies |

|||||

|

1 |

1st quarter of

2018 |

1,433 |

1.766,350 |

188 |

760,864 |

|

2 |

2nd quarter of

2018 |

1,729 |

2,104,945 |

170 |

678,343 |

|

3 |

3rd quarter of

2018 |

1,369 |

1,643,956 |

255 |

787,276 |

|

4 |

4th quarter of

2018 |

1.106 |

1,289,829 |

289 |

1,175,124 |

|

5 |

1st quarter of

2019 |

1,044 |

1,244,893 |

331 |

985,636 |

|

6 |

2nd quarter of

2019 |

1,019 |

1,292,606 |

260 |

878,857 |

|

7 |

3rd quarter of

2019 |

922 |

1,162,542 |

269 |

1,086,480 |

|

8 |

4th quarter of

2019 |

651 |

800,573 |

199 |

599,693 |

|

Vehicles with other

insurance policies |

|||||

|

1 |

1st quarter of

2018 |

1,130 |

1,047,601 |

274 |

1,225,717 |

|

2 |

2nd quarter of

2018 |

1,293 |

1,336,660 |

245 |

1,150,498 |

|

3 |

3rd quarter of

2018 |

1,095 |

1,117,935 |

199 |

915,445 |

|

4 |

4th quarter of

2018 |

1,144 |

1,049,565 |

178 |

813,200 |

|

5 |

1st quarter of

2019 |

1,362 |

1,375,988 |

214 |

1,216,293 |

|

6 |

2nd quarter of

2019 |

1,417 |

1,491,511 |

262 |

873,208 |

|

7 |

3rd quarter of

2019 |

1,356 |

1,432,006 |

289 |

1,441,465 |

|

8 |

4th quarter of

2019 |

9,095 |

10,235,056 |

267 |

1,134,300 |

4.2. Prognosis of economic indices of vehicle insurance

Tab.

5 contains a summary of input data divided into separate economic indices. Data

is presented in the descending order.

Tab.

5

Input data in descending order

|

|

I |

II |

III |

IV |

V |

VI |

VII |

VIII |

|

Number of damage cases covered –

package policies |

||||||||

|

|

331 |

289 |

269 |

260 |

255 |

199 |

188 |

170 |

|

Number of damage cases covered – other

policies |

||||||||

|

|

289 |

274 |

267 |

262 |

245 |

214 |

199 |

178 |

|

Amount of compensation – package

policies |

||||||||

|

|

117,5124 |

108,6480 |

985,636 |

878,857 |

787,276 |

760,864 |

67,8343 |

599,693 |

|

Amount of compensation – other

policies |

||||||||

|

|

144,1465 |

1,225,717 |

1,216,293 |

1,150,498 |

1,134,300 |

915,445 |

873,208 |

813,200 |

|

Premium income – package policies |

||||||||

|

|

2,104,945 |

1,766,350 |

1,643,956 |

129,606 |

1,289,829 |

1,244,893 |

1,162,542 |

800,573 |

|

Premium income – other policies |

||||||||

|

|

1,491,511 |

1,434,937 |

1,432,006 |

1,375,988 |

1,336,660 |

1,117,935 |

1,049,565 |

1,047,601 |

|

Number of insured vehicles – package

policies |

||||||||

|

|

1,729 |

1,433 |

1,369 |

1,106 |

1,044 |

1,019 |

922 |

651 |

|

Number of insured vehicles – other

policies |

||||||||

|

|

1,417 |

1,362 |

1,359 |

1,324 |

1,293 |

1,144 |

1,130 |

1,095 |

Using

the formulas presented in the previous section, prognosis equations for

individual economic indices was derived.

Number

of damage cases covered – package policies

![]()

Number of damage cases

covered – other policies

![]()

Amount of compensation

– package policies

![]()

Amount of compensation

– other policies

![]()

Premium income –

package policies

![]()

Premium income –

other policies

![]()

Number of vehicles

insured – package policies

![]()

Number of vehicles

insured – other policies

![]()

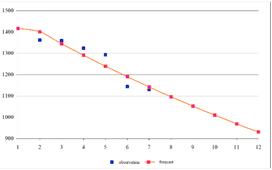

Tab.

6 contains a summary of input data and predicted values calculated using the

equations presented above. A – stands for input value, B –

predicted value. Figs. 5 to 8 present the distribution of analysed economic

indices of the insurance business.

Tab. 6

Summary of input data and predicted values

|

|

I |

II |

III |

IV |

V |

VI |

VII |

VIII |

IX |

X |

XI |

XII |

|

Number of damage cases covered –

package policies |

||||||||||||

|

A |

331 |

289 |

269 |

260 |

255 |

199 |

188 |

170 |

- |

- |

- |

- |

|

B |

331 |

298 |

273 |

250 |

229 |

210 |

192 |

176 |

162 |

148 |

136 |

125 |

|

Number of damage cases covered – other

policies |

||||||||||||

|

A |

289 |

274 |

267 |

262 |

245 |

214 |

199 |

178 |

- |

- |

- |

- |

|

B |

289 |

286 |

267 |

249 |

232 |

216 |

201 |

188 |

175 |

163 |

152 |

142 |

|

Amount of compensation – package

policies x 1000 |

||||||||||||

|

A |

1,175 |

1,086 |

985 |

878 |

787 |

760 |

678 |

599 |

- |

- |

- |

- |

|

B |

1,175 |

1,079 |

980 |

891 |

809 |

735 |

668 |

607 |

552 |

501 |

455 |

414 |

|

Amount of compensation – other

policies x 1000 |

||||||||||||

|

A |

1,441 |

1,225 |

1,216 |

1,150 |

1,134 |

915 |

873 |

813 |

- |

- |

- |

- |

|

B |

1,441 |

1,285 |

1,196 |

1,113 |

1,036 |

964 |

897 |

835 |

777 |

723 |

672 |

626 |

|

Premium income – package policies x

100 |

||||||||||||

|

A |

21,049 |

17,663 |

16,439 |

12,926 |

12,898 |

12,448 |

11,625 |

8,005 |

- |

- |

- |

- |

|

B |

21,049 |

17,647 |

15,877 |

14,284 |

12,851 |

11,562 |

10,403 |

9,359 |

8,420 |

7,576 |

6,816 |

6,132 |

|

Premium income – other policies x 100 |

||||||||||||

|

A |

14,915 |

14,349 |

14,320 |

13,759 |

13,366 |

11,179 |

10,495 |

10,476 |

- |

- |

- |

- |

|

B |

14,915 |

14,980 |

14,092 |

13,256 |

12,470 |

11,730 |

11,034 |

10,380 |

9,764 |

9,185 |

8,640 |

8,128 |

|

Number of insured vehicles – package

policies |

||||||||||||

|

A |

1,729 |

1,433 |

1,369 |

1,106 |

1,044 |

1,019 |

922 |

651 |

- |

- |

- |

- |

|

B |

1,729 |

1,459 |

1,309 |

1,174 |

1,052 |

944 |

846 |

759 |

681 |

610 |

547 |

491 |

|

Number of insured vehicles – other

policies |

||||||||||||

|

A |

1,417 |

1,362 |

1,359 |

1,324 |

1,293 |

1,144 |

1,130 |

1,095 |

- |

- |

- |

- |

|

B |

1,417 |

1,401 |

1,345 |

1,291 |

1,239 |

1,190 |

1,142 |

1,096 |

1,052 |

1,010 |

969 |

931 |

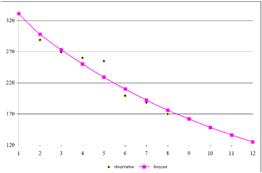

a)  b)

b)

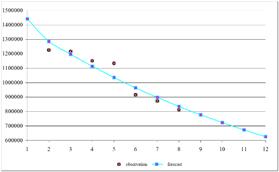

Fig. 5. Number of damage cases covered a) package

policies, b) other policies

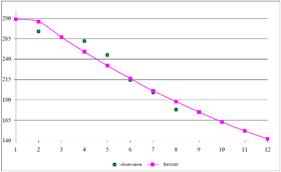

a)  b)

b)

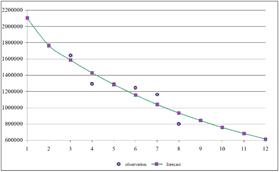

Fig. 6. Amount of paid compensation a) package

policies, b) other policies

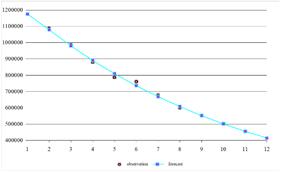

a)  b)

b)

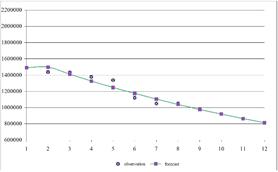

Fig. 7.

Premium income amount a) package policies, b) other policies

a)  b)

b)

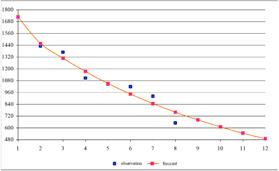

Fig. 8.

Number of insured vehicles a) package policies, b) other policies

The accuracy of the

method has been determined using Equations 10 to 13. Probability P for each ![]() exceeds 0.95 in all analysed indices.

This posits that the proposed method is correct.

exceeds 0.95 in all analysed indices.

This posits that the proposed method is correct.

5. CONCLUSIONS

The results presented in

Section 4 indicate that the prognosis suggested a probable decrease in the

value and quantity of each analysed economic index of vehicle insurance.

The decreasing trend is

reasonably related to the number of insurance policies and the amount of paid

compensation. The number of newly registered cars for which liability insurance

is legally required is constantly increasing. Road statistics with reference to

the number of cars cited in 2.3 above show a decreasing trend. The value of

paid compensation is largely affected by the post-accident repair cost

estimate. The number of used cars imported to Poland is still high. Although

their age varies, most cars are several years old. Costs of accident repairs in

these vehicles quite often exceed their market value, which is reflected in

lower amounts of paid compensation.

Currently, monitoring of

the analysed indices is about to start so as to verify if the results obtained

using the Grey System Theory method correspond to the actual economic situation

in 2020.

References

1.

Bodziony

M., T. Kądziołka, A. Kochanek, S. Kowalski. 2016. “Work time analysis of drivers in the aspect of

road traffic safety”. Autobusy:

technika, eksploatacja, systemy transportowe 6: 85-94. ISSN 1509-5878.

2.

Kądziołka

T., S. Kowalski. 2016. “Analysis of road traffic safety exemplified by

selected road crossings”. Autobusy:

technika, eksploatacja, systemy transportowe 12: 235-241. ISSN 1509-5878.

3.

Kowalski S., A.

Zwolenik. 2019. “Analysis of the company's operating costs on the example

of a transport company”. Autobusy:

technika, eksploatacja, systemy transportowe 6: 311-314. ISSN 1509-5878.

4.

Bodziony

M., T. Kądziołka, A. Kochanek, S. Kowalski. 2016. “Work time analysis of drivers in the aspect of

road traffic safety”. Autobusy:

technika, eksploatacja, systemy transportowe 6: 85-94. ISSN 1509-5878.

5.

Kądziołka

T., A. Kochanek, S. Kowalski, 2016. “Cost

analysis of fuel consumption by motor vehicles”. Prace Naukowe Politechniki Warszawskiej. Transport 112: 175-183.

ISSN 1230-9265.

6.

Wyborkierowcow.pl.

“The

worst and best insurance companies in 2019”. Available at: https://www.wyborkierowcow.pl/najgorsze-i-najlepsze-firmy-ubezpieczeniowe-w-2019-roku/.

7.

„Knowledge

base - Statistics”. Available at: https://www.krbrd.gov.pl/.

8.

Wang S., P. Wang,

Y. Zhang. 2020. “A prediction method for urban heat supply based on grey

system theory”. Sustainable Cities

and Society 52: 1-7.

9.

Anton Bezuglov A.,

G. Comert. 2016. “Short-term

freeway traffic parameter prediction: Application of grey system theory models”.

Expert Systems with Applications 62: 284-292.

10.

Hosse René

S., U. Becker, H. Manz. 2016. “Grey systems theory time series prediction

applied to road traffic safety in Germany”. IFAC-PapersOnLine

49(3): 231-236.

11.

Jui-Chen Huang.

2011. “Application

of grey system theory in telecare”. Computers in

Biology and Medicine 41: 302-306.

12.

Ma F.Y., W.H.

Wang. “Prediction of

pitting corrosion behavior for stainless SUS 630 based on grey system theory”.

Materials

Letters 61: 998-1000.

13.

Alfaro-Saiz J.J.,

M.C. Bas, V.G. Bosch, R. Rodríguez-Rodríguez, M.J. Verdecho.

“An evaluation

of the environmental factors for supply chain strategy decisions using grey systems

and composite indicators”. Applied

Mathematical Modelling: 1-16

14.

Tabaszewski M.

2014. “Prediction of diagnostic symptom values using a set of models

GM(1,1) and a moving window method”. Diagnostyka

15(3): 65-68.

Received 02.03.2020; accepted in revised form 17.05.2020

![]()

Scientific

Journal of Silesian University of Technology. Series Transport is licensed

under a Creative Commons Attribution 4.0 International License