Article

citation information:

Mindur,

M. The development of sea transport in South Korea

between 2002-2017. Scientific Journal of Silesian University of

Technology. Series Transport. 2019, 105,

183-199. ISSN: 0209-3324. DOI: https://doi.org/10.20858/sjsutst.2019.105.15.

Maciej MINDUR[1]

THE

DEVELOPMENT OF SEA TRANSPORT IN SOUTH KOREA

BETWEEN 2002-2017

Summary. The transformation of South Korea from one of the

poorest countries in the world in the 1950s to an industrial power and a member

of OECD was exceptionally fast. The policy promoting the import of raw

materials and the latest technologies enabled Korea to join the group of the

most rapidly growing economies in the world in 2004. Such an imposing growth

rate was the result of booming industrial production, trade expansion to Asian,

American and European markets and a liberal economic policy. The Korean economy

is the most foreign-trade dependent country of all OECD members, with sea

transport playing a predominant role. This article analyses basic Korean

macroeconomic indicators within 2002-2018, with particular emphasis on the GDP.

It discusses sea transport figures, including the cargo handling capacity of

Korean ports, as well as port and logistics operations and the throughput of

Busan, the largest South Korean and one of the largest seaport in the world.

Additionally, this article shows innovation and ecology focus in the port of

Busan, and primary directions of the state policy in the field of

environmentally friendly growth.

Keywords: South Korea, port of

Busan, cargo handling, modern technology, ecology

1. INTRODUCTION

Next to Taiwan,

Singapore, Malesia and Thailand, South Korea is considered as one of the newly

industrialised countries. These countries have a relatively developed public

sector, reduced income disparities and high labour productivity. All

above-mentioned countries noted rapid economic growth due to their offensive

export policy and specialisation in manufacturing of highly processed

industrial goods, which require the latest technologies.

The transformation of

South Korea from one of the poorest countries in the world in the 1950s to an

industrial power and a member of OECD was exceptionally fast (South Korea is a

member of various international organisations, such as UN, G-20, Association

of Southeast Asian Nations and World Trade Organization). The policy promoting

the import of raw materials and the latest technologies enabled Korea to join

the group of the most rapidly growing economies in the world in 2004. Such an imposing

growth rate was the result of booming industrial production, trade expansion to

the Asian, American and European markets and a liberal economic policy[2].

In 2018, South Korea was the seventh largest

exporter and 11th largest economy in the world[3].

The Korean shipbuilding

industry, competing with that of China and Japan, significantly contributes to

the growth of the South Korean economy. In the

1970s and 1980s, South Korea became the lead producer of ships, including

supertankers and oil rigs[4]. The country has maintained this status until today.

Such

a fast economic growth needs to be matched with large capacity

handling seaports. Busan, the largest South Korean transhipment

port of south-east Asia and the fifth busiest container port in the world[5], boasts of

its outstanding results in this area.

2. SOUTH

KOREAN ECONOMY

The development strategy

of South Korea, a country that inherited industry, infrastructure and

bureaucracy from Japan after the Japanese occupation, followed the footsteps of

the same country. Therefore, after economic difficulties, the country started a

phase of rapid economic growth as late as 1963[6].

Still, in the 1960s, the GDP per capita in South Korea was comparable to that

of poorer countries in Africa and Asia. However, it grew from 6% of the OECD average in 1970 to 89% in 2017[7].

In 2002–2008, the

GDP was stable (with 4.65% average growth), whereas the lowest level was noted

in 2009 (0.7%) as a result of a drop in export due to the global economic

crisis. Nevertheless, due to direct stimulation

measures implemented by the Korean government and strong domestic consumption,

which compensated major reduction of exports, the Korean economy avoided

recession contrary to the majority of industrialised economies, and the country

noted positive economic growth in two consecutive years into the crisis. In

2010, the GDP growth was 6.5%, until 2018 when the economic growth slightly

slowed down (with average annual growth of 3%). Initially, it was the result of

shrinking domestic consumption and investment, and recently also the result of

the downturn in exports, the economic slowdown in China and US customs policy

towards Chinese goods (Tab. 1)[8].

In the period concerned, the unemployment rate was low and stable (from

3.1 to 3.8%).

Tab. 1

Basic macroeconomic figures in Republic of Korea in

2002-2018 (annual change in %)

|

Item |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

GDP |

7,4 |

2,9 |

4,9 |

3,9 |

5,2 |

5,5 |

2,8 |

0,7 |

6,5 |

3,7 |

2,3 |

2,9 |

3,3 |

2,8 |

2,9 |

3,1 |

2,7 |

|

Private

consumption |

8,9 |

-0,5 |

0,3 |

4,4 |

4,6 |

7,2 |

6,0 |

2,7 |

7,0 |

6,7 |

4,2 |

2,9 |

2,8 |

3,1 |

2,5 |

2,6 |

2,8 |

|

Total

investment |

6,9 |

4,8 |

2,9 |

2,0 |

3,6 |

5,0 |

-0,9 |

0,3 |

5,5 |

0,8 |

-0,5 |

3,3 |

3,4 |

5,1 |

5,6 |

8,6 |

1,6 |

|

Unemployment

rate |

3,3 |

3,6 |

3,7 |

3,7 |

3,5 |

3,2 |

3,2 |

3,6 |

3,7 |

3,4 |

3,2 |

3,1 |

3,5 |

3,6 |

3,7 |

3,2 |

3,8 |

|

Government

gross debt (% GDP) (surplus/deficit) |

3,5 |

1,6 |

0,1 |

0,9 |

1,1 |

2,2 |

1,4 |

-1,5 |

1,3 |

1,4 |

1,3 |

1,0 |

0,6 |

0,0 |

1,0 |

1,4 |

1,7 |

|

Current

account balance |

0,8 |

1,8 |

3,9 |

1,4 |

0,4 |

0,9 |

0,2 |

3,7 |

2,6 |

1,4 |

4,0 |

5,9 |

5,9 |

7,6 |

6,9 |

4,9 |

4,7 |

|

Export |

13,0 |

13,9 |

20,6 |

7,8 |

12,1 |

12,7 |

7,5 |

-0,3 |

12,7 |

15,1 |

5,1 |

4,3 |

2,0 |

- 0,1 |

2,6 |

1,9 |

5,5 |

Source: The World Bank

Of all OECD countries,

the Korean economy is the most dependent on foreign trade, which accounts for

over 80% of its GDP, whereas goods and services exported

from South Korea account for 43.1% of the total Korean production. The

most important trade partner for South Korea is China. In 2018, China’s

import of Korean goods (chiefly electronic components) was 26.8% of the Korean

exports. An equally important trade partner was the United States (12.1%),

Vietnam (8%), Hong Kong (7.6%) and Japan (5.1%). As regards the continental

distribution of Korean exports, Asia accounts

for two thirds (67%) in terms of the value, North America 14.9%, and Europe

11.4% (including Germany 1.5%)[9]. The most valuable outbound shipments include

electronic chips, refined oil products (oils), cars and spare parts and

accessories.

Tab. 2

Main

exports from South Korea

|

Item |

Value, in bn USD |

% of total export |

|

Electrical machinery, equipment |

184,6 |

30,5 |

|

Machines including computers |

77,7 |

12,8 |

|

Vehicles |

61,2 |

10,1 |

|

Mineral fuels including oil |

48,2 |

8,0 |

|

Plastics, plastics articles |

34,9 |

5,8 |

|

Optical, technical and medical apparatus |

27,8 |

4,6 |

|

Organic chemicals |

25,4 |

4,2 |

|

Iran, steel |

24,8 |

4,1 |

|

Ships, boats |

20,3 |

3,4 |

|

Articles of iron or steel |

10,5 |

1,7 |

Source: http://www.worldstopexports.com/south-koreas-top-10-exports/

The strengths of the

Korean economy include its competitive factors. GDP spending on research and

development (R&D) has been growing as well as the manufacturing of hi-tech

products, which are the main export goods. Globally recognised Korean companies

include Samsung, Hyundai, LG and Kia Motors.

3. SOUTH

KOREAN SEA TRANSPORT

Sea transport plays an

important role in South Korean trade, especially as it has a land border with

North Korea only. Across its territorial waters, South Korea borders Japan in the east and south and China in the west. Since

the country is separated from the Asian mainland, Korean ports are

tremendously important in export and import[10].

South Korea has a large

number of various shipping companies. At the same time, the prolonged

stagnation on the container transport market and heavy competition translated

into a crisis for South Korean shipping companies. In 2017, Hanjin Shipping,

the seventh largest container transport company in the world, went bankrupt.

Therefore, the Korea Shipping Partnership, a coalition of 14 South Korean

container transport companies, was formed to strengthen the domestic sea

shipping sector and regain trust among previous foreign trade partners. The

alliance was aimed at enhancing the competitiveness of the domestic

container-shipping sector, among others, by opening new shipping lines,

cooperation in developing the fleet, provision of joint services at

international terminals and consultations on the reduction of operating costs.

In the 1970s and 1980s, South Korea had become the

leading global manufacturer of ships, including supertankers and oil rigs. The

main shipbuilding company in Korea is Hyundai, which in the middle of 1970s

built the Ulsan Shipyard. Today, the

shipyard operates ten dry docks with nine Goliath cranes. This enables the

production of virtually any type and size of ship. Until 2018, the

shipyard built over 2119 ships for 324 ship owners from 52 countries[11]. In

2017, Daewoo Shipbuilding secured a contract worth 4.8 bn USD for 15 ice class

arctic tankers to transport LNG from the Russian Jamal LNG Terminal. The

government of South Korea developed a program worth 1.9 bn USD to support shipbuilding

companies in winning more projects, in particular for LNG carriers[12].

The 2018 order by Hyundai

Merchant Marine provides for 20

mega-container vessels (twelve of 23 thou. TEU and eight of 14 thou. TEU) to be

built by Daewoo Shipbuilding & Marine Engineering, Hyundai Heavy Industries

and Samsung Heavy Industries. Moreover, Korean shipyards stand much

chance to win one of the largest contracts ever for about 60 LNG carriers for

Qatar[13].

The said bankruptcy of

Hanjin Shipping, which dramatically reduced sales figures in the Korean

shipping sector, forced the government to focus on strengthening the

shipbuilding industry. Specific steps include a three-year plan of building 200

ships by Hyundai Merchant Marine,

included 140 bulk carriers and 60 container carriers[14]. Moreover, the government undertook to adjust ships to stringent environmental regulations

adopted by the International Maritime Organization (IMO) pertaining to the reduction of sulfur oxides (SOx)

emission from ships. Begining from 2020, the global sulfur cap is going

to be 0.5% m/m.

In

2017, the Republic of Korea had 1907 ships, including 89 container carriers,

394 general cargo vessels, 201 tankers and 1123 other ships[15].

In 2017, the total cargo handling capacity of Korean ports was 1164 m tons, which accounted for 1.6 times increase from 737 m tons in 2007 and 2.4 times compared to 2002. When compared with 2016, cargo handling increased by 23.653 m tons (2.1%). The total capacity of vessels under the national flag was 45.729 m. Compared with the previous year, the capacity increase by 1134 m tons (2.5%) as regards tonnage, by 965 thou. tons (1.9%) in DWT and nearly 106 thou. TEU (44.9%)[16]. Tab. 3 Cargo handling by ports and ships registered under the Korean flag

Year |

Cargo handling capacity, in thou. tons |

Ships under the national flag |

||

Tonnage (tons) |

DWT (tons) |

Containers (TEU) |

||

2002 |

486 889 |

15 295 015 |

- |

- |

2007 |

737 456 |

24 139 666 |

- |

- |

2010 |

928 524 |

31 285 948 |

- |

- |

2012 |

1 017 190 |

40 128 889 |

- |

- |

2013 |

1 024 977 |

43 709 221 |

- |

- |

2014 |

1 109 669 |

46 196 572 |

50 378 310 |

471 976 |

2015 |

1 139 693 |

46 498 120 |

50 962 232 |

516 606 |

2016 (A) |

1 140 799 |

44 595 009 |

50 482 148 |

235 003 |

2017 (B) |

1 164 452 |

45 728 557 |

51 446 672 |

340 514 |

Change |

23 653 |

1 133 548 |

964 524 |

105 511 |

Rate (%) |

2,1 |

2,5 |

1,9 |

44,9 |

Source: Explore Korea through Statistics 2018, p. 72.

Six Korean major ports

are located on the coast, including the largest port of Busan. Other large

ports include Gunsan (Kunsan), Gwangyang,

Incheon, Masan, Mokpo and Ulsan.

In total, in 2017, South Korean ports handled 1.57 bn

tons of cargo. Compared to the previous year, it counted for an increase of

4.1%. The largest increase was noted in the transport of vehicles (14.4%),

lignite (11.6%) and machinery (8.3%), whereas in the handling of sand and steel,

the sector noted a decrease of 35.9 and 12.8%, respectively. At the same time,

container handling increased by 1.7% to 1.09 bn tons, whereas the container

transport increased by 5.4% to 27.42 bn TEU.

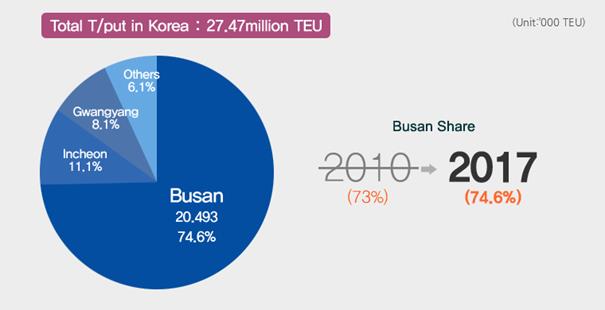

In 2017, ports of Busan, Gwangyang and Incheon noted an increase in

cargo handling by 10.5, 3.1 and 2.4%, respectively, chiefly due to the growing

export of vehicles and import of coal and machinery. The contribution of those

ports to the total container traffic in Korean ports is shown in Fig. 1. In

2017, the Port of Busan handled 400.5 m tons of cargo, Gwangyang 291.83 m tons,

and the port of Ulsan 202.36 m tons. Increased demand for microchips and

petrochemical products translated into the increase in export to China by 9%,

and to the United States by 6.7%[17].

Fig.

1. Container handling in ports of Busan, Gwangyang and Incheon in 2017

Source: http://www.busanpa.com/eng/Contents.do?mCode=MN0042

Fig. 2. Container traffic in the ports of the Republic of Korea in 2002–2017 (million TEU)

Source:

https://data.worldbank.org/indicator/IS.SHP.GOOD.TU?end=2017&locations=KR&name_desc=true&start=2000&view=chart

4.

PORT AND LOGISTICS ACTIVITY IN THE PORT OF BUSAN

The largest Korean

port of Busan is situated at the estuary of the

Naktong River. In 2016, it was the largest cargo port in South-East Asia and the fifth busiest container port in the world[18],

and in 2017, it was the sixth largest port regarding container handling (Tab.

4). The length of the coastline of the port is 26.8 km. Thus, enabling the

mooring of 169 ships at the same time, including passenger and oil terminals,

and handles 91 m tons annually[19].

Tab. 4

Containers handled in ten

busiest ports in the world in 2016

|

Position |

Port |

2016 |

2017 |

Increase, in % |

|

1 |

Shanghai |

37 133 |

40 300 |

8,5 |

|

2 |

Singapore |

30 904 |

33 666 |

8,9 |

|

3 |

Shenzhen |

23 997 |

26 000 |

7,3 |

|

4 |

Ningbo |

21 560 |

25 970 |

20,4 |

|

6/5 |

Hong Kong |

19 579 |

20 750 |

4,8 |

|

5/6 |

Busan |

19 456 |

20 473 |

5,2 |

Source:

https://english.busan.go.kr/bsport

The

port of Busan consists of four modern sections: North Port, South Port, Gamcheon Port and Dadaepo Port. It also includes

five container terminals and three passenger terminals. The port infrastructure

is complemented by well-equipped logistics centres.

The North Port handles both

passengers and cargo, and its capacity is extended by the Gamcheon Port (ship

technology). In the South Port is located the Busan Cooperative Fish Market,

the largest fish processing hub in Korea, dealing with 30% of the total sea

catch. It operates processing plants and cold storage facilities necessary to

support fish product retail. Located

in the west is the Dadaepo Port, which

previously handled ships scheduled for maintenance and passenger vessels, and

supports coastal fishing. Although the port

meets all requirements of an environmentally friendly port, it will be

transformed into an ecological port in the future.

The

Jaseongdae container terminal occupies an area of 624 km2. It is

operated by Hutchison Korea Terminals Co. The terminal berth of 1447 m can

receive four ships of up DWT 50 thou. at once. The annual cargo handling

capacity of the terminal is 1.7 m TEU.

UAM,

another container terminal, occupies 182 km2 and the length of its

berth is 500 m. It can handle one ship of DWT 20 thou. and two ships of 5 thou.

tons. The annual cargo handling capacity of the terminal is 300 thou. TEU.

Yet

another container terminal Gamman of 727 km² is operated by four companies, namely, Global Enterprises, Hanjin Shipping,

Korea Express and Hutchison Korea Terminal Ltd. The terminal is furnished with

modern container handling equipment. The length of the berth is 1400 m and it

is sufficient for mooring four vessels of up to DWT 50 thou. The annual cargo

handling capacity of the terminal is 1.56 m TEU.

Opened

in June 1991, the Sinseondae container terminal of 1170 km² is equipped

with advanced loading and unloading systems, including large speed container

cranes capable of handling Post-Panamax container carriers. The operator for

the terminal is CJ Korea Express Busan Container Terminal Co. Ltd. Some of the

facilities include a berth of 1500 m capable of receiving five ships of up to

DWT 50 thou. The annual cargo handling capacity of the terminal is 2 m TEU.

Singamman,

a container terminal established in April 2002, is operated by Dongbu Busan

Container Terminal Co. Ltd. Its berth of 826 m enables handling of two vessels

of DWT 50 thou. and one of DWT 5 thou. It occupies an area of 294 km² and

has an annual cargo handling capacity of 780 thou. TEU.

Since August 2012, the Busan Port International Ship

Chandling Center has been operating in the port

of Busan. A complex of five-level buildings of over 33 thou. m2

house, most modern warehouses and offices. The centre supports airports,

seaports and rail hubs providing comprehensive administration, logistics and

port services necessary to promote efficient shipments.

In

1997, to improve the attractiveness of port services and guarantee speedy and

efficient cargo handling, the decision to develop a new technologically

advanced mega-port of Busan New Port (BPA)

was made. The first stage of the port development was implemented by 2006, and

its completion is scheduled for 2020.

The deep-sea Busan

New Port (draft in excess of 17 m) is situated west of the old port on the Island of Gaduk. It is furnished

with modern technological equipment and infrastructure, including innovative

automated systems (for example, latest berth-side cranes, UAVs, automated

gantry cranes, real-time monitoring systems) capable of handling vessels of 19

thou. TEU. The current 23 berthing facilities for container carriers (target is

45) are suitable for handling 10 m TEU annually[20].

1 5 4 3 2![]()

![]()

![]()

![]()

![]()

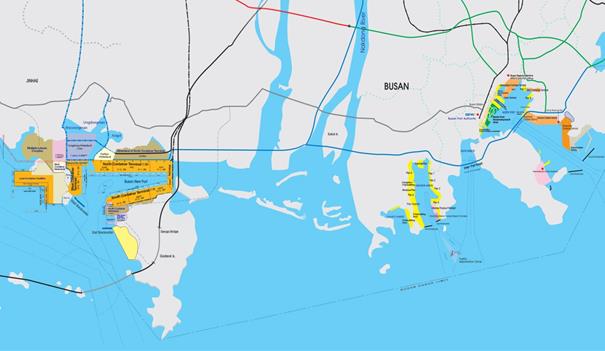

Fig. 3. Ports of Busan (left: 1 – Busan New

Port, 2 – Dadaepo Port, 3 – Gamcheon Port, 4 – South Port, 5

– North Port)

Source:

http://www.busanpa.com/eng/Contents.do?mCode=MN0031

Tab. 5

Current status and particulars of container terminals in the port of

Busan

|

|

Jaseongdae |

Shinseondae |

Gamman |

Shingamman |

Uam |

|||

|

Total area (thou. ㎡) |

624 |

1170 |

727 |

294 |

182 |

|||

|

CY area (1000㎡) |

335 |

804 |

384 |

153 |

156 |

|||

|

Berth length (m) |

1447 |

1500 |

1400 |

826 |

500 |

|||

|

Capacity (DWT) |

50,000 × 4 |

50,000 × 5 |

50,000 × 4 |

50,000 × 25,000

× 1 |

20,000 × 1 5,000

× 2 |

|||

|

Capacity (1000 TEU) |

1722 |

2236 |

1600 |

819 |

300 |

|||

|

Draft (m) |

15 |

15 ~ 16 |

15 |

15 |

11 |

|||

|

In operation since |

1978/9 |

1991/6 |

1998/4 |

2002/4 |

1996/9 |

|||

|

Operator |

Korea Huchson Terminal

Co., Ltd. |

KBCT |

BICT, BGCT |

Dongbu Busan Co., Ltd. |

- |

|||

|

Busan New Port |

||||||||

|

|

Jetty 1 |

Jetty 2 |

Jetty 3 |

Jetty 4 |

Jetty 5 |

|||

|

Total area (thou. ㎡) |

840 |

1210 |

688 |

553 |

785 |

|||

|

CY area (1000㎡) |

282 |

525 |

346 |

213 |

154 |

|||

|

Berth (m) |

1200 |

2000 |

1100 |

1150 |

1400 |

|||

|

Ship handling in DWT |

50,000 × 3 |

50,000 × 6 |

50,000 × 6 |

50,000 × 2 |

50,000 × 4 |

|||

|

Capacity |

2091 |

3677 |

2310 |

1936 |

2440 |

|||

|

Draft (m) |

16 |

16 ~ 17 |

18 |

16 ~ 17 |

17 |

|||

|

In operation since |

2010/3 |

2006/1 |

2009/2 |

2010/2 |

2012/1 |

|||

|

Operator |

PNIT |

PNC |

Hanjin New Port

Company Terminal (HJNC) |

Hyundai Pusan New-Port

Terminal, Ltd. |

BNCT Inc. |

|||

Source:

https://english.busan.go.kr/bsport

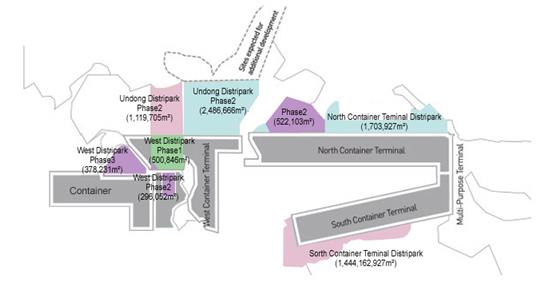

In the Busan New Port – Distripark

(Fig. 4), an integrated logistics complex still under construction, companies

will be able to provide logistics, distribution and shipping services to international

businesses, as well as companies based in the Free Economic Zone of Busan-Jinhae.

Distripark has been designated as a free

trade zone where foreign logistics businesses can enjoy affordable rent and tax

exemptions. The total logistics operation area of 8.5 km2 is

expected to support processing, storage, sorting, labelling, testing, packaging

and warehousing of goods shortly before their delivery to customers, as well as

disassembly/assembly services for automotive components and door-to-door

service. Distripark has access to all modes of

transport, including seaports, airports, rail and road. The completion

of the project is scheduled for 2030[21].

Fig. 4.

Distripark Plan

Source: http://www.busanpa.com/eng/Contents.do?mCode=MN0068

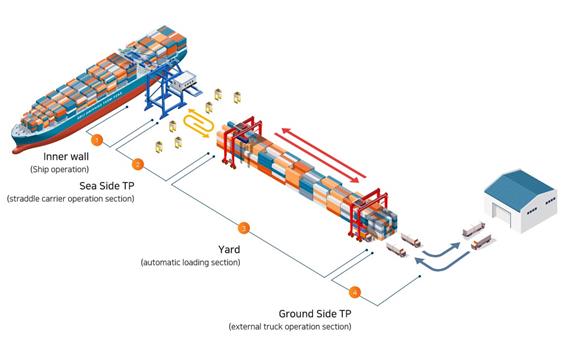

The Busan New Port uses the latest technologies and facilities. For

example, at

jetty 5, due to the vertical automation project and latest operating equipment,

stevedoring equipment in each section can operate independently which

translates into high productivity. The number of trucks entering the port is

limited to reduce congestion and risk of accidents, as well as the CO2

emission. The jetty 5 operation system is shown in Fig. 5. The figure includes 1) loading/unloading of containers

to/from a ship using a container crane, 2) transfer of cargo to the berth – a frame bridge vehicle transports

containers from the ship side (inner wall) to the container yard at the

waterfront, 3) port services – container yard operation is fully

automated, including an automatic gantry crane and transport of containers from

the container bay to the seaside (automatic loading section) or the ground side

(external truck operation), 4) crossing

the gate – when a truck approaches the gate, the

RFID system checks its ID data. At the same time, the monitoring system at the

gate identifies the container. When the container passes the gate, the system

designates a working area and directs the driver to the relevant section.

BPA also plans to

facilitate the flow of cargo between the old and new ports (a distance of 25

km) and it is now implementing an inter-terminal transfer (ITT) platform to

optimise truck operation between the two facilities, as well as to reduce

overall cost[22].

Since the measures are a part of a long-term strategy, BPA is going to consider

subsidising certain costs incurred by shipping companies.

Fig.

5. Cargo handling at jetty 5 in Busan New

Port

Source: https://www.intergis.co.kr/eng/CMS/Contents/Contents.do?mCode=MN061

5. CAPACITY OF BUSAN

SEAPORT

The

port of Busan handles nearly 40% of the total cargo volume transported by sea,

80% containers and 42% domestic fish catch and fish products. The port handles

130 ships per day. The number of containers handled in the port has been

gradually growing. In 2017, the port handled 20.5 m TEU, which accounted for

42% increase compared with 2005 and 5% compared with 2016.

In

2017, the port of Busan handled 5,022,321 TEU in import, 5,143,952 TEU in

export and 10,225,417 TEU in transhipment (T/S). The total 2017 container

handling in the port was 20,493,475 TEU (Table 6).

Tab. 6

Containers throughput in the port of Busan in import, export and T/S in

2004-2017 (in TEU)

|

Year |

Total traffic |

Inbound |

Outbound |

T/S |

Coastal |

|

2017 |

20 493 475 |

5,022,321 |

5,143,952 |

10.225.417 |

81 785 |

|

2016 |

19 456 291 |

4,801,127 |

4,819,339 |

9,835,826 |

0 |

|

2015 |

19,486,725 |

4,713,229 |

4,650,168 |

10,105,318 |

10 |

|

2014 |

18 683 283 |

4,596,287 |

4,657,639 |

9,429,355 |

3 |

|

2013 |

17,686,099 |

4,424,105 |

4,509,339 |

8,748,453 |

4,202 |

|

2012 |

17,040,567 |

4,381,636 |

4,426,418 |

8,142,052 |

90 461 |

|

2011 |

16,184,706 |

4,402,736 |

4,305,315 |

7,352,539 |

124,116 |

|

2010 |

14,194,334 |

3,913,611 |

3,922,723 |

6,276,458 |

81,542 |

|

2009 |

11 980 325 |

3 266 708 |

3 302 018 |

5,372,485 |

39.114 |

|

2008 |

13 452 786 |

3,853,127 |

3,784,946 |

5,807,848 |

6 865 |

|

2007 |

13 261 484 |

3,752,747 |

3,691,003 |

5,811,167 |

6567 |

|

2006 |

12 038 786 |

3,429,141 |

3,374,042 |

5,207,731 |

27 772 |

|

2005 |

11 843 151 |

3,309,202 |

3,270,036 |

5,178,798 |

85115 |

|

2004 |

11 491 968 |

3,286,361 |

3,308,609 |

4,791,942 |

105 056 |

Source: http://www.busanpa.com/eng/Contents.do?mCode=MN0042

6. INNOVATION AND ENVIRONMENTAL APPROACH IN PORT OF BUSAN

The

ever increasing sizes of vessels and growing volumes of cargo in ports

necessitated innovation. In order to preserve competitiveness, new technologies

are introduced globally, such as combined data exchange platforms, cloud

services and mobile devices[23].

Furthermore, the port of Busan is modernising its infrastructure in line with

the latest trends to catch up with global leaders, in particular, Chinese ports

that dominate in the region.

In

2019, the port plans to introduce the IoT platform together with KL-NET[24].

KL-Net supports electronic data exchange (EDI) in logistics, integration of

systems, IT advisory and logistics solutions for the maritime industry in South

Korea[25].

The system supports, among others, electronic exchange of the entry/leave declaration,

cargo declaration, as well as reservation, bill of lading, transport and

shipment. After the introduction of the system, IoT sensors in containers will

enable real-time information exchange, including location, ambient temperature

and humidity of cargo.

The port of Busan uses

the Tandem-40' system that enables the simultaneous handling of two 40' or four

20’ containers. Modern quayside cranes can load up to 8 levels of

containers on a ship (11 pcs) and 10 levels (1 pcs) in the case of standard containers.

It is also possible to stack 24 rows (width of container stacking). The tandem

system can handle from 35 to 40 containers, whereas regular cranes handle from

25 to 30 containers[26].

Cargo handling is supported by 38 unmanned

automatic electric cranes (ATC) in the Hyundai

Busan Newport Terminal.

The Port of Busan is interested in using the blockchain technology[27] that helps to reduce cost related to paper freight documentation and customs payments. Such a decentralised and distributed database of transactions is accessible over the internet and can be used for recording individual transactions, payments and accounting records. The blockchain technology does not require the operation of central computers and does not have a centralised data storage. At the same time, the coding based on encryption algorithms makes it resistant to cyberattacks. The blockchain technology is already used to protect data of containers, tracing and tracking of cargo in Antwerp and Rotterdam[28].

In line with the Framework Act on Low Carbon, Green Growth, adopted by the Korean government in 2010, the port of Busan promotes “green management of port operations”[29]. Diesel engines in a number of machines and equipment have been replaced with electric ones which significantly reduced the emission of greenhouse gases. With the aim of improving energy efficiency, roofs of warehouses and gates are furnished with PV panels, and office facilities in the New Port of Busan also use geothermal and solar energy. Moreover, ships of higher Environmental Ship Index[30] may enjoy exemptions or reduced rates of port fees.

In 2018, the Port of Busan

entered into a cooperation contract with Korea Gas Corporation (KOGAS) to

develop a bunkering system in the port. Both companies undertook to develop a

feasibility study for the LNG bunkering method to

supply LNG to ships entering the port of Busan. Under the project, the parties

are going to examine LNG bunkering systems and various business issues, and in

2019, a floating LNG bunkering terminal would be built. A gradual shift to LNG

propulsion in the national fleet is expected to significantly reduce the emission of

solid particles from ships. According to the

governmental agency, the emission from ships of total sulfur oxides and solid

particles account for 73 and 51%[31], respectively, in

the city of Busan

7. SUMMARY The multiple-year government intervention and investment in modern technologies made South Korea one of the most developed economies in the region. The government focuses on the development of the industry and speedy implementation of new technologies in existing and new facilities to expedite economic growth, boost production of goods, especially those to be exported to foreign markets, and develop competitive advantages. Not without significance was the financial aid for the South Korean economy granted by the United States (in 1946–1978, the United States offered about 60 bn USD in grants and loans). Yet another important factor was the financial crisis of 1997, triggered by the bankruptcy of six out of the thirty largest industrial conglomerates (chaebol). Then, the Korean government received a loan of 58 bn USD from the International Monetary Fund. The loan was granted with conditions that Korea tightens its fiscal and monetary policy and engage in far-reaching market reforms in sectors of finance and corporations, as well as the labour market policy. Additionally, South Korea agreed to open its economy to foreign goods and investors[32].

The South Korean maritime policy has been shaped by three major factors, namely, the geopolitical situation, shortage of natural resources and the socio-economic program. The latter led to the creation of new jobs in the 1980s, the establishment of the pension system and improvement of the living standard. Therefore, the role of Korean ports in the national economy is particularly important, since they account for 99% of inbound and outbound goods[33].

The concentrated activity enhanced the position of the port of Busan and turned it to one of the most important logistics centres in South-East Asia. One of its advantages is the strategic location on the crossroads from North-East China, Japan and Russia, within the main transport corridor to Europe and America. The port of Busan enjoys excellent natural conditions, such as sheltering by nearby mountains and islands, considerably limited ebbs and three main sea routes in the vicinity.

According to the mid-term and long-term strategic plans of the Port of Busan, the quality of port services should improve to reach 30 m TEU by 2025. The modernisation and extension of the port, implementation of modern cargo handling technologies and the building of a broad logistics network to establish a mega-hub is to attract global companies and enhance the creation of new jobs. Activities planned are accompanied by incentives to establish one’s business in the port, such as tax and customs exemptions and business consulting[34].

Korea

is at the forefront of green growth initiatives. The 2009-2050 National

Strategy for Green Growth and the five-year plan (2009-2013) established a

comprehensive state policy framework in Korea, promoting environmentally

friendly growth both short and long-term. In the longer-term perspective, the

National Strategy for Green Growth is designed to promote new

initiatives to improve the status of the natural environment and living

standards for citizens, as well as active participation in international

climate change programs.

References

1.

BCG. To Get Smart, Ports Go Digital. Available at: https://bcg.com/publications/2018/to-get-smart-ports-go-digital.aspx.

2.

Bloomberg. Available at:

https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=9637232.

3.

Buková Bibiána, Eva

Brumerčíková, Pavlína Kolářová.

2015. “A study of a logistics transport chain in the transport of

selected commodity from eastern Europe to China”. Naše More 62(4): 256-263.

4.

Busan Port. Available at: https://www.busanpa.com/eng/Contents.do?mCode=MN0031.

5.

Busan

Port Logistics. Available at: https://english.busan.go.kr/bsport.

6.

Busan Port Authority. Available at: http://www.busanpa.com/eng/.

7.

Busan Regional Office of Oceans and

Fisheries. Available at: http://portbusan.go.kr/eng/contents/intr010101.jsp.

8.

Dynamic BUSAN. Available at: https://www.investkorea.org/busan_en/project/project.do?mode=view&articleNo=202208.

9.

EveryCRSRReport.com, South Korea-U.S.

Economic Relations. Available at: https://www.everycrsreport.com/reports/RL30566.html#_Toc228343868.

10. Explore

Korea through Statistics 2018.

11. GreenPort, Environmental

Stewardship at Busan. Available at: https://www.greenport.com/news101/asia/environmental-stewardship-at-busan.

12. GreenPort, Port

of Busan Bunkering Agreement. Available at: https://www.greenport.com/news101/lng/port-of-busan-bunkering-agreement.

13.

Indexmundi. Available at: http://www.indexmundi.com/south_korea/merchant_marine.html.

14.

INTERGIS.

Available at: https://www.intergis.co.kr/eng/CMS/Contents/Contents.do?mCode=MN061.

15. Knoema. Available at: https://knoema.com/atlas/Republic-of-Korea/Current-account-balance-as-a-share-of-GDP.

16. Lee K. South Korea’s Infrastructure

Vision, Reconnecting Asia. 2018. Available at: https://reconnectingasia.csis.org/analysis/entries/south-koreas-infrastructure-vision/.

17. List of ports in South Korea. Available

at: https://www.searoutes.com/country-ports/South-Korea.

18.

Medium. South Korean Blockchain Week in

Busan -Lucid Crypto and Module Token. Available at: https://medium.com/@nakanishi.g1106/south-korean-blockchain-week-in-busan-lucid-crypto-and-module-token-f605f2d5de8c.

19. Mindur

L. (Ed.). 2014. Technologie transportowe.

[In Polish: Transport technologies]. Radom: ITE-PIB.

20. Mindur M. (Ed.). 2017. Logistyka. Nauka-badania-rozwój

[In Polish: Logistics.

Science-research-development]. Radom: ITE-PIB.

21. Mindur M. 2010. Transport w erze globalizacji. [In Polish:

Transport in the age of globalization]. Radom: ITE-PIB.

22.

Obed Ndikom, Nwokedi Theophilus C., Sodiq

Olusegun Buhari. 2017. “An appraisal of demurrage policies and charges of

maritime operators in nigerian seaport terminals: the shipping industry and

economic implications”. Naše

More 64(3): 90-99.

23.

OECD Better Policies for Better Lives.

Available at: http://www.oecd.org/economy/korea-economic-snapshot/.

24.

Port Technology. Available at: https://www.porttechnology.org/news/busan_in_massive_10bn_expansion_plan.

25.

PortalMorski.pl: South Korea orders 200

ships. Available at: https://www.portalmorski.pl/stocznie-statki/38944-korea-poludniowa-zamawia-200-statkow.

26.

PSA HPNT. Available at:

https://www.hpnt.co.kr/homepage/eng/webpage/ter_equ.jsp.

27.

Safety 4Sea. Available at: https://safety4sea.com/south-korean-ports-see-4-1-volume-increase-in-2017/.

28. Ship Technology.

Available at: https://www.ship-technology.com/projects/hyundai-heavy-industries-ulsan-korea/.

29.

Ship Technology. Available at: https://www.ship-technology.com/projects/portofbusan/.

30. The World Bank.

Container port traffic. Available at:

https://data.worldbank.org/indicator/IS.SHP.GOOD.TU?end=2017&locations=KR&name_desc=true&start=2000&view=chart.

31.

The Korea Bizwire. Available at:

http://koreabizwire.com/busan-port-incorporates-iot-to-boost-competitiveness/77548.

32.

The Wall Street Journal, Korea’s

Mega-Merger of Shipyards Set to Dominate Global Shipbuilding. Available at: https://www.wsj.com/articles/koreas-mega-merger-of-shipyards-set-to-dominate-global-shipbuilding-11549475888.

33.

The World Bank. Available at: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=KR.

34.

The World

Factbook. Available at: https://www.cia.gov/library/publications/the-world-factbook/geos/ks.html.

35.

World Shipping Council. Available at: http://www.worldshipping.org/about-the-industry/global-trade/top-50-world-container-ports.

36.

World's Top Exports. Available at: http://www.worldstopexports.com/south-koreas-top-10-exports/.

Received 14.09.2019; accepted in revised form 09.11.2019

![]()

Scientific

Journal of Silesian University of Technology. Series Transport is licensed

under a Creative Commons Attribution 4.0 International License