Article

citation information:

Szabo, S, Pilát, M.,

Tobisová, A., Makó, S. Operational statistics

of Kosice Airport. Scientific Journal of Silesian

University of Technology. Series Transport. 2019, 102, 197-203. ISSN: 0209-3324. DOI: https://doi.org/10.20858/sjsutst.2019.102.16.

Stanislav SZABO[1],

Marek PILÁT[2], Alica TOBISOVÁ[3],

Sebastián MAKÓ[4]

OPERATIONAL

STATISTICS OF KOSICE AIRPORT

Summary. The main aim of the article is to

bring the understanding of operational statistics of airports closer to readers.

What is the essence of the execution and what belongs to them. For this

article, we chose the Airport Kosice and present its operational statistics in

a specific year. In the introduction are some business companies at the airport

as well as the airport itself. The number of transported passengers as one of

the most basic airport operation services is dealt with in the scheduled and

non scheduled passenger transport for the chosen year. Finally, it is connected

to the global overtaking operations of Kosice Airport. All of these indicators

are graphically displayed for easier comprehension for the reader, the portions

of the transported passengers for each selected transport segment.

Keywords: operational statistics,

airport, scheduled and non-scheduled passengers

1. INTRODUCTION

Monitoring the

operational statistics is based on the overall productivity and performance of

the airport. The main aim is to increase performance and revenue and reduce

company costs.

The number of

transported passengers, the number of take-offs and landings and the land

movements of the aircraft all determine the operating performance of the

airports. The number of these indicators is reflected in the total revenue

which translates into the company’s profit. These indicators are

monitored for airline passengers departing from the airport and transfer

passengers. A more specific indicator may be used for passengers on scheduled

flights, charter flights or classic and low-cost airlines. Several authors have

dealt with this subject and have pointed out that it is an issue in the

performance evaluation of international airports in the region of East Asia by

Chang et. al. In this research, the hierarchical structure of evaluating

airport performance evaluation problem will be constructed based on four

aspects: supply, airline demand, passenger demand and management side [12]. In

the commercial performance of global airports, Fuerst

et al. stated that the revenues from non-aeronautical business have received

increasing attention from airports seeking to enhance their

profitability [13].

Malavolti talked about State Aids granted by regional airports:

a two-sided market analysis and there is a lot of cases had risen in the past

decade about agreements between regional airports and low-cost

carriers [14]. Dynamically

interdependent business model for airline airport coexistence by Minato et. al. observed that the

load factor guaranteed

a dynamically interdependent business model for

airline-airport coexistence where an airline and an airport agree on the load

factor of a flight, after which either party compensates for any discrepancies

between the actual and the agreed-upon load factor [15]. Kratudnak et. al. in the paper

“Analysis of key factors for airport service quality: A case study of three

regional airports in Thailand” commented that airports open their

doors to visitors and investors from around the world crucially boosting

the economy, trade, investment, and tourism of countries throughout the

world [16].

2. SPECIFIC INFORMATION ABOUT

AIRPORT AND AIRLINE COMPANIES

Kosice

Airport history was basically a military airport until 1910. Today, it is an

international airport with a market share of 66% for Vienna airport and 34% for

the Department of Transportation SR. Airport capacity is differentiated for

800,000 passengers per year. Passengers can get to over 500 destinations around

the world with one transfer from Vienna, Warsaw, Prague and Istanbul. [1] [2]

Wizz Air is a low-cost

carrier Hungarian company founded in 2003. The first aircraft took off from

Katowice in 2004 and currently, it has 600 lines with 25 bases. As of August

2018, the company transported 3,476,091 passengers around the world. [3] [4]

Czech Airlines have its

main base in Prague founded in 1923 offering a classic transport product.

Travel Service is current a major shareholder (97.735%) with the rest of the

share owned by Česká poisťovňa (2.265%). The latest

passenger data is 2,900,590 from 2017. [5]

Austrian Airlines is a

part of the Lufthansa Group covering approximately 130 destinations in Central

and Eastern Europe. The company’s history dates back to 1918, however, the

company was officially founded in 1957 and took off for the first time in 1958.

The company has 83 aircraft with a base at Schwechat Airport in Vienna. The

best year for Austrian Airlines was 2017 when 12.9 million passengers travelled

around the world using the airline. [6] [7]

LOT Polish Airlines

classic airline established in 1929, currently operates 73 aircraft. The main

hub is Warsaw Chopin Airport and the approximate number of transported

passengers per year is 7 million. [8] [9]

Turkish Airlines founded

in 1933 with a vision to operate more than 500 aircraft for passenger and cargo

transportation by 2023. The company has 78 aircraft available and operates over

304 destinations in 122 countries. As of April 2018, the company has

transported 23 million passengers. A point of interest to note in 2017 is

Turkish Airlines which transported 68,616,740 passengers all over the world. [10]

Travel Service is the

largest Czech airline operating under the SmartWings trademark scheduled

charter and business flights. The company also collaborates on aircraft leasing

with companies such as Air Explore (AXE) and Go2Sky. The foundation of the

company was established in 1997 and it has transported more than 7 million

passengers in 2017. [11]

3. OPERATIONAL STATISTICS FOR THE YEAR 2017

The chosen year of 2017

for this article recorded 436,696 passengers transported by Kosice airport, an

increase of 6.39% over the previous year. The largest increase in passengers

was recorded in the scheduled transportation segment with an increase of up to

18.85 %. This year recorded 9,367 aircraft movements (+ 11.17%) the most

pronounced decline in percentage terms belongs to cargo transport at 65.06%. [2]

3.1 Scheduled passenger transport

Scheduled passenger

transport was operated by five airlines to destinations with scheduled

departure time. These destinations include; Bratislava, Prague, Vienna,

London, Istanbul and Warsaw. Figure 1 is the percentage impression of each

airline's share of scheduled transportation for the selected year. The largest

share of passengers belongs to the low-cost company, Wizz Air with 57.7%.

The second place belongs to Czech Airlines with a percentage of 20.6% on

scheduled flights. In the current year, Austrian Airlines carried 15.5% of

passengers en route from Košice to Vienna. LOT Polish Airlines contributed

4.3% and Turkish Airlines 1.9% where it should be recalled that Turkish

Airlines flew from Košice until June 2016. It is possible to understand

the percentage of Turkish Airlines for the half year at 1.9% which is really a

good number for a newly established route from Kosice to Istanbul. [2]

Table 1 listed below

shows the number of passengers transported with airlines concerned at the

Kosice airport. [2]

Tab. 1

Transported

passengers on scheduled flights.

|

Airline |

Number of transported

passengers |

|

Wizz

Air |

201,366 |

|

LOT

Polish Airlines |

14,997 |

|

Turkish

Airlines |

6,485 |

|

Czech

Airlines |

71,987 |

|

Austrian

Airlines |

54,144 |

Fig. 1. Scheduled transport for the chosen

year 2017

The largest number of

passengers was transported by the low-cost airline, Wizz Air (201,366) and the

least transported by Turkish Airlines (6,485). For Turkish Airlines this

average number is due to the later start of operations at the airport compared

to other airlines. [2]

3.2 Non

Scheduled passenger transport

Kosice Airport due to

the global predicament and crisis in Turkey had a significant drop in the

number of passengers carried on chartered flights. The year on year decline was

25% which represents the worst balance for the summer season during the last

ten years. The largest share of passengers that travelled with airline Smart

Wings was 43.78%, while Travel Service was 39.14%. Third place belongs to the

Bulgarian Air Charter with 7.23% transported passengers. [2]

In table 2 are the

percentages of visited destinations for the selected year. As you can see the

largest number of passengers was transported to Bulgaria (34.1%) and the least

to favourite destinations of previous years, Egypt and Israel (0%). Croatia had

the smallest non-zero number (0.9%). Kosice Airport has tried to prolong the

charter season in spite of unfavourable conditions but has failed without

success. This is due to the fact that the summer season starts from June to

mid-September which is a very short time for the summer season and

non-scheduled flights. Travel agencies work on the principle of limiting

business risks as much as possible. The summer season has been shortened due to

product demand forecasts of weak competition in the market and absence of

a year- round offer of at least one holiday destination and a number of

other factors that have significantly affected the selected summer season. [2]

Tab. 2

Non-Scheduled passengers.

3.3 Global

operational statistics

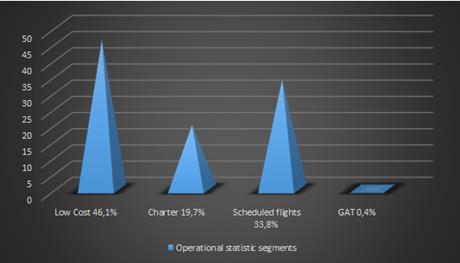

In the global scale,

low-cost charter scheduled and general aviation flights were involved in the

operating performance. The detailed share is shown in figure 2 which is

expressed per percentage point for each factor contributing to the overall

airport operating performance. [2]

Fig. 2.

Global operational statistic segments

The largest percentage

in the global operating performance was the low-cost transport (46.1%), second

place to scheduled transport (33.8%), third place (19.7%) for charter

passengers and last general aviation terminal with 0.4%. [2]

4. CONCLUSION

The main aim of this

article was to point out the operational statistics of Kosice Airport for the

selected year 2017. As can be seen, the largest proportion of passengers

transported by Wizz Air low-cost airline is worth up to 58% of total scheduled

flights. The second place has Czech Airlines with 21%, Austrian Airlines with

15%, LOT Polish Airlines with 4% and Turkish Airlines with 2%. On the global

scale, this meant 46.1% for low-cost, 19.7% for charter flights, 33.8% for

scheduled flights and 0.4% for General Aviation Terminal. Burgas in Bulgaria

and Greek destinations such as Heraklion or Rhodes was the most visited

destinations in the non-scheduled perspective. The chosen year of 2017 had a

record number of passengers transported close to almost half a million per year

which is a very positive figure for a small international airport.

References

1.

Airport Kosice a.s. Official website.

Available at: https://www.airportkosice.sk

2.

Internal materials.

3.

Wizzair statistics. Official website.

Available at: https://corporate.wizzair.com/en-GB/investor_relations/traffic_statistics.

4.

Wizzair. Official website.

Available at: https://wizzair.com.

5.

Czech Airlines. Official website.

Available at: https://www.csa.cz/cz-en/about-us/.

6.

Austrian Airlines. Official website.

Available at: https://www.austrian.com.

7.

Traffic Results for the

Entire Year 2017: Record Year with 12.8 Percent Growth in Passenger Volume. Press Corner 2018.

Available at: https://www.austrianairlines.ag/Press/PressReleases/Press/2018/01/002.aspx?sc_lang=en&mode=%7B309_3.

8.

LOT Polish Airlines. Official website.

Available at: https://corporate.lot.com/pl/en/.

9.

Star Aliance Member

Airline. Official

website. Available at: https://www.staralliance.com/en/member-airline-details?airlineCode=LO.

10. Turkish Airlines. Official website. Available at:

https//www.turkishairlines.com.

11. Travel service. Official website. Available at:

https://www.travelservice.aero/o-spolecnosti/.

12. Chang Y.H. et. al.

“Performance evaluation of

International Airports in the region of East Asia”. Eastern Asia Soc

Transport At Studies.

13. Fuerst Franz et. al.

“The commercial performance of global airports”. Transport

Policy 61: 123-131.

14. Malavolti Estelle et.

al. 2017. “State Aids granted by regional airports: a two-sided market

analysis”. 14th World Conference on Transport Research (WCTR).

15. Minato N. et. al. 2017. „Dynamically interdependent business model for airline

airport coexistence”. Journal of Air Transport Management 64, Part B:161-172.

16. Kratudnak S. et. al.

“Analysis of key factors for airport service quality: A case study of

three regional airports in Thailand”. International Conference on

Industrial Engineering and Operations Management. Bandung, Indonesia, March 6-8, 2018.

Received 18.11.2018; accepted in revised form 15.02.2019

![]()

Scientific

Journal of Silesian University of Technology. Series Transport is licensed

under a Creative Commons Attribution 4.0 International License