Article

citation information:

Mindur, L., Mindur, M. Technological advances

in the development of the US railways against the competitiveness of the

economy in the years 2000-2017. Scientific

Journal of Silesian University of Technology. Series Transport. 2019, 104, 119-135. ISSN: 0209-3324. DOI: https://doi.org/10.20858/sjsutst.2019.104.11.

Leszek MINDUR[1],

Maciej MINDUR[2]

TECHNOLOGICAL ADVANCES IN THE DEVELOPMENT OF THE

US RAILWAYS AGAINST THE COMPETITIVENESS OF THE ECONOMY IN THE YEARS 2000-2017

Summary. The overall

contribution of the railway sector in the American economy is substantial.

Since 2000, the volume of rail freight transport services in the United States

has remained on a balanced and invariably high level, even though the total

length of the railway network has declined. Over the recent years, owing to the

deployment of advanced software and state-of-the-art technologies, rail freight

transport has been performing more effectively than ever. This article

addresses a study of the rate of GDP changes compared with measures reflecting

the transport services performed in the years 1995-2015. This study comprised

the transport performance achieved by means of railways (in billion tkm)

against other transport sectors within 2000-2016 and addresses the volume of

freight transport services performed in the American transport network. The

authors discussed the mechanism functioning of rail freight transport, which is

becoming an increasingly attractive means of transport, with reference to the

intermodal freight transport, including the double-stack system. They have analysed the share of intermodal transport

in the structure of domestic and non-domestic freight transport services in

2017. Furthermore, the latest observed trends in the American railway network

in the sphere of the use and implementation of the state-of-the-art

technologies supporting railway traffic management was brought to light with

regard to the improvement of safety and assisting the relevant authorities.

Keywords: US economy, rail transport, technological

advancement, safety.

1. INTRODUCTION

The dynamic advancement of American rail transport is

determined by the continuous development of the economy. American railways

transport more than two billion tonnes of raw materials and finished products

annually using nearly 130,000 miles of railway lines that cut through 49

states. The increasing demand for the supply of goods to a wide range of

industries and consumers in the country, as well as to global markets, has

contributed to linking the internal market from the east to the west coast and

connecting it with the rest of the world.

The overall contribution of the railway sector in the

American economy is quite substantial, creating more than 1 million jobs,[3]

and increasing tax revenues and the gross

domestic product. Suppliers and service providers operating in the railway

directly employ more than 125,000 people in production, repair, maintenance and

leasing. Moreover, for every worker directly employed by the railway sector, further

4.2 jobs are supported by the business environment in its broad understanding,

which means that 650,000 jobs are linked with goods suppliers and railway

service providers, as well as their supply chains or the expenses of those whom

these companies employ[4].

American railways were originally established and still

currently operated on a nearly exclusive basis of private capital. Railway

entrepreneurs who own both the infrastructure and the rolling stock are

responsible for their maintenance, upgrading and repairs, while ensuring the

flow capacity of the routes they manage. In most lines, advanced technologies

are either already supported or presently being implemented, which has made it

possible to increase traffic safety over recent years as well as to partially

relieve roads of heavy vehicle traffic.

2. MAIN TRENDS IN THE DEVELOPMENT OF THE US

ECONOMY

The United States of America is the largest and most

important economy in the world. Its GDP value was USD 19.4 billion in 2017,

which accounted for over 18% of the world’s gross domestic product[5].

The United States has maintained its position of world economic leader for many

decades, leaving far behind both the dynamically developing China (with its

2017 GDP of USD 12.0 billion), Japan (USD 4.9 billion) and Germany (USD 3.7

billion). In terms of GDP per capita, the United States was ranked 8th

in 2017 (USD 59.9 thousand per capita), being second only to smaller countries

such as Luxembourg, Switzerland, Macao, Norway, Iceland, Ireland and Qatar.

Fig. 1. Countries with the highest GDP worldwide

Source:

https://inzynieria.com/wpis-branzy/rankingi/10/52442,najwieksze-gospodarki-swiata-2018,pozycja-rankingu-4-niemcy-3-68-bln-usd

The USA is the largest (single country) free-market economy

in the world[6].

Compared to the economies of the European Union, it is characterised by

significantly higher liberalism, lower taxes and absence of extensive social

security schemes.

Fig. 2. Trends in the American GDP in the years 2000-2017

Source: https://tradingeconomics.com/united-states/gdp

The US economy is dominated by a highly developed and

technologically advanced service sector, which accounts for nearly 80% of the

GDP. Production is equally important, as it accounts for ca. 19% of the GDP[7].

The United States is the world’s second largest producer and leader

in the automotive, aviation and

aerospace, machine building, telecommunications and chemicals industries [8].

Following the global economic crisis of 2009, owing to the

massive government financial support, the US economy started recovering from

the recession. Its economic growth has also benefited from such activities as

research, implementation of innovation and capital investments. One cannot

disregard the fact that the US possesses and extracts vast natural resources

(including crude oil, natural gas and hard coal). December

2017 saw the implementation of a tax reform which, starting from 2018,

effectively reduced the tax rates binding for companies from 35 to 21%.

Individuals are also subject to lower taxes, and many other tax reliefs and

deductions were changed[9].

The reduced corporate tax rates have been introduced for good, while the

reliefs for individuals are expected to expire past 2025.

Despite the fact that the United States currently enjoys very

good economic conditions, the country still faces numerous significant

challenges. These include deteriorating infrastructure, stagnation in wages,

growing income inequalities and costs of universal health insurance coverage,

as well as a growing current account deficit and budget deficit[10].

Further potential threats include the

recent changes in the foreign trade policy, which have undoubtedly had an

impact on economic growth. The current state policy which entails imposing

duties on imported goods is intended to encourage US consumers to purchase

domestic products. Customs duties have been imposed on imports of certain goods

from China, Mexico, Canada and the European Union, and it should be noted that

all these countries have taken retaliatory action. In January 2017, the US

representation broke negotiations concerning the Transatlantic Trade and

Investment Partnership (TTIP) between the European Union and the United States.

Experts are not in a position to predict whether and when talks on the adoption

of this agreement will resume[11].

Faced with the current situation and the declining export volumes, US companies

are anxious about the growing political and regulatory risks, especially since

emerging markets are facing their own issues and the eurozone is experiencing

economic growth deceleration.

Such an economic situation affects the condition of

transport, as it is closely associated with other economic sectors. An increase

in production translates into an increase in demand for transport services, as

shown in Fig. 3. The 2018 share of transport and warehousing in the GDP was

nearing USD 546 million (2.8% of total GDP)[12].

Fig. 3. Share of transport and warehousing in the US GDP in

the years 2006-2018

Source: https://tradingeconomics.com/united-states/gdp-from-transport

3. ECONOMIC GROWTH VS. FREIGHT AND PASSENGER TRANSPORT

SERVICES

The actual growth of the economy and transport services is

well described by the polynomial curves, and confirmed by the R2

coefficients. Figure 4 shows the growth of the US economy and transport

services in the years 1995-2015. The variables included in the figure have been

compiled with reference to real data based on the polynomial curve.

Macroeconomic variables and transport measures are

characterised by steady growth, and the highest growth is demonstrated by the

polynomial curve describing the GDP, the second highest being that of the

passenger transport curve, while the lowest level trend is one which describes

freight transport performance. The rate of changes in the GDP compared to the

measures reflecting transport services within the period subject to analysis,

has been steadily increasing (with the only abrupt decline observed in 2009),

which implies that the economy grew faster than the transport sector, and that

the share of transport services in the American GDP has been decreasing.

4. DEVELOPMENT OF THE US RAILWAYS

The US rail transport is

dominated by freight services, while passenger services, once a large and

important part of the domestic rail transport, now plays a limited role

compared to many other countries in the world.

Fig. 4. Macroeconomic indices

characterising the economy (GDP) and measures of transport services (tkm and

pkm) in the United States of America

Source: North American Transportation

Statistics Database 2007-2015, available at:

http://www.rita.dot.gov/bts/data_and_statistics

The history of the development of the US railways dates

back to the years 1762-1764, when the first railway line was built by British

military engineers in areas near the Niagara Falls in Lewiston, to be used by a

vehicle known as a mechanised tram[13].

In 1826, the 4.8 km long Granite Railway line was opened to transport stone

blocks from the local quarry to the port on the Neponset River near Boston. In

the construction of this line, 1,524 mm gauge wooden rails with iron overlay

were used. The first (unsuccessful) attempt to use the Stourbridge Lion steam

locomotive took place on the railway line from Carbondale to Honesdale,

Pennsylvania, in 1829. In 1830, a 21 km long B&O railway section connecting

Baltimore and Ellicott’s Mills was commissioned, featuring horse

traction. The same year saw the opening of the

Tuscumbia–Courtland–Decatur RR (Alabama) horse railway, established

to transport cotton, and it was the first railway west of the Appalachians,

later to become a part of the SOU network. Other important events included the

opening of a section of the first regular steam traction line in January 1831

(with the Best Friend of Charleston steam locomotive) near Charleston, operated

by the South Carolina Canal & RR Co., extended in 1833 to Hamburg, running

on a track of the 1,524 mm gauge. The railway was built at a great pace and

with great savings, using flat and wooden rails, and track substructure instead

of embankments. It was later gradually adapted to normal standards[14].

The first transcontinental line, 3,067 km in

length, was built in the 1860s, connecting the existing eastern railway network

in Omaha (Nebraska) with the Pacific coast in Oakland Long, San Francisco Bay[15].

This investment laid the foundation for the creation of a modern transport

system in the United States. Much of the original route is still used today.

The railway line construction investments of the second half of the 19th

century had the greatest impact on the American transport system of the time.

Following the standard historical interpretation, railway lines were crucial

for the development of the domestic market in the United States and served as a

model for the organisation, financing and management of a large corporation[16].

The contemporary US railway network is the longest in the

world (Fig. 2). In 2017, its total length came to 126,195 miles,[17]including

93,339 miles (data of 2016) of class I lines, with 21,358 miles managed by the

main rail passenger transport operator, Amtrak, with the US federal government

as the major shareholder.

American freight railways are divided into three classes

based on the distances they cover and the wages, and so there are seven large

class I railway lines, 21 regional class II lines, and 547 short class III

lines. Class I railways were operated using more than 26,000 locomotives. Ca.

1,500,000 freight cars are currently used in the United States, and they are

broken down according to technical specifications as follows:[18]:

-

open cars –

540,000 units

-

box cars –

360,000 units

-

tank cars –

255,000 units

-

platform cars –

210,000 units

-

refrigerator cars

– 135,000 units

The

main carriers operating class I lines are[19]:

-

Burlington Northern

and Santa Fe Railway (BNSF), established in 1996 by the merger of ATSF and BN,

currently one of the largest railway companies

-

CSX Transportation

(CSXT): established in 1987 by the merger of Chessie System (former C&O of

B&O) with Seaboard Air Line RR, Atlantic Coast Line RR, Louisville &

Nashville RR; presently, one of two railway systems functioning east of

Mississippi

-

Norfolk Southern

Combined Railroad Subsidiaries (NS): railway company established in 1990,

mainly on the basis of the SOU railway network, the first Norfolk Southern

Rly., Virginian Rly., Norfolk & Western RR, half of the Conrail network;

along with the CSXT railway, it services the east of the country

-

Union Pacific RR (UP)

-

Grand Trunk Corp

-

Soo Line Railroad

-

Kansas City Southern

Railway (KCS)

Fig. 5. Percentage share of cars in freight transport

services according to body types

Source: authors’ own study based on:

https://www.bts.gov/sites/bts.dot.gov/files/docs/browse-statistical-products-and-data/transportation-statistics-annual-reports/215041/tsar-2017-rev-2-5-18-full-layout.pdf

Next to the aforementioned major corporations, the US rail

freight market is also served by regional railway operators, local railways as

well as railway companies providing shunting and terminal services.

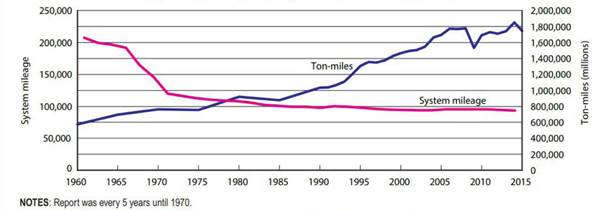

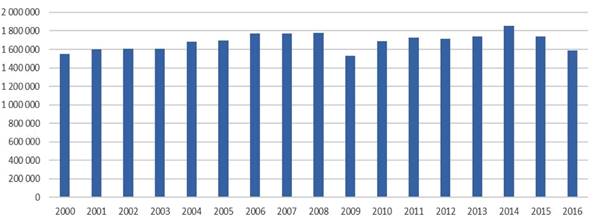

Since 2000, the volume of rail freight transport

services in the United States has remained on a balanced and high level, even

though the total range of the railway network has declined. Between 1990 and

2013, the length of class I railways decreased by almost 30%, and many sections

were transformed into short lines or simply abandoned,[20]however,

this reduction has not undermined the high growth rate of freight transport

(Fig. 6). The volume of railway transport performance has been compared with

other modes of transport in Table 1, while the cargo volume in tonnes

transported by rail between 2000 and 2016 is illustrated in Fig. 7.

Transport services in the United States are dominated by

road transport. Congested and frequently in poor condition (since a passenger

car is by far the most popular means of transport for Americans), road have not

been sufficiently subsidised for many years, and are becoming increasingly

dangerous. On average, 1/3 less transport is carried out by rail. The exception was 2014, when the rail and road transport

performance was at a similar level. The volume of transport services was

affected by the global economic crisis of 2009 and the economic slowdown of

2012 in the aftermath of the significant reduction in federal spending, mainly on

defence[21].

Fig. 6. Changes in the mileage of means of rail transport

and transport performance in the years 1960-2015 in tonne-miles

Source:

https://www.bts.gov/sites/bts.dot.gov/files/docs/browse-statistical-products-and-data/transportation-statistics-annual-reports/215041/tsar-2017-rev-2-5-18-full-layout.pdf

Tab. 1.

Transport performance by transport modes in the years

2000-2016, in millions of tonne-miles

|

Year |

Transport mode |

||||

|

Road |

Rail |

Pipeline |

Air |

Total |

|

|

2000 |

2,326,524 |

1,546,319 |

967,819 |

14,983 |

5,501,444 |

|

2001 |

2,362,063 |

1,599,332 |

924,162 |

13,069 |

5,520,312 |

|

2002 |

2,427,693 |

1,605,532 |

880,504 |

13,370 |

5,539,180 |

|

2003 |

2,478,740 |

1,603,564 |

875,570 |

15,231 |

5,579,251 |

|

2004 |

2,427,170 |

1,683,895 |

870,635 |

16,451 |

5,619,322 |

|

2005 |

2,453,347 |

1,696,425 |

865,700 |

15,002 |

5,621,751 |

|

2006 |

2,405,811 |

1,771,897 |

860,766 |

14,702 |

5,614,804 |

|

2007 |

2,495,786 |

1,770,545 |

855,831 |

14,612 |

5,689,924 |

|

2008 |

2,752,658 |

1,777,236 |

981,323 |

13,133 |

6,044,871 |

|

2009 |

2,449,509 |

1,532,214 |

947,252 |

11,503 |

5,417,599 |

|

2010 |

2,512,429 |

1,691,004 |

955,986 |

12,026 |

5,673,656 |

|

2011 |

2,643,567 |

1,729,256 |

1,018,082 |

11,590 |

5,902,243 |

|

2012 |

1,890,797 |

1,712,567 |

856,873 |

11,836 |

4,946,,830 |

|

2013 |

1,941,029 |

1,740,687 |

842,392 |

11,883 |

5,001,082 |

|

2014 |

1,993,456 |

1,851,229 |

867,379 |

12,273 |

5,228,831 |

|

2015 |

2,002,544 |

1,738,283 |

876,456 |

12,519 |

5,120,429 |

|

2016 |

2,022,879 |

1,585,440 |

896,320 |

13,157 |

4,995,657 |

Source:

https://www.bts.gov/sites/bts.dot.gov/files/docs/bts_program_resources.pdf

Fig. 7. Volume of cargo transported by rail in the years

2000-2016, in tonne-miles

Source: https://www.bts.gov/sites/bts.dot.gov/files/docs/bts_program_resources.pdf

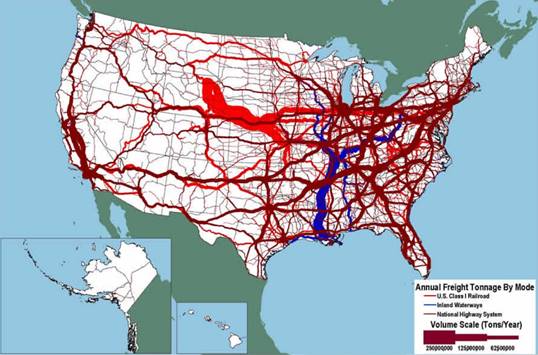

Fig. 8. Freight transport volumes in the US transport

network

Source: US Intermodal Network; available at:

http://www.worldshipping.org/industry-issues/transportation-infrastructure/u-s-intermodal-network

5. TECHNICAL PROGRESS OF THE US RAILWAYS

Intermodal transport is the most rapidly

growing segment of the rail market in the United States, as the volume of

intermodal transport services has tripled over the last 25 years[22]. In 2018, freight railways carried 14.5 million

intermodal units[23]. Intermodal transport services are perfect for

enabling cooperation between long-distance railways and door-to-door road

transport.

Intermodal transport plays a crucial role

in building significantly more efficient logistics by suppliers and sellers,

while its high efficiency translates into enormous competitive advantage of the

United States in the global economy. The US intermodal network forms a common

system of government agencies (owners of roads, bridges and ports) and private

companies (managing or operating other system components, including heavy

vehicles, trains, tracks and most port terminals).

The share of intermodal transport in the structure of

domestic and non-domestic freight transport services in 2017 was analysed in

Table 2.

Tab. 2.

Share of intermodal transport in the

structure of domestic and export freight transport services in 2017.

|

Cargo type |

Domestic |

Non-domestic |

||

|

QTY |

% |

QTY |

% |

|

|

Intermodal |

14,256,000 |

48.7% |

14,729,000 |

48.0% |

|

Coal |

4,738,000 |

16.2% |

4,623,000 |

15.1% |

|

Other goods not elsewhere classified |

2,352,000 |

8.0% |

2,933.000 |

9.6% |

|

Non-metallic minerals |

1,782,000 |

6.1% |

1,773,000 |

5.8% |

|

Chemicals |

1,725,000 |

5.9% |

1.920.000 |

6.3% |

|

Agricultural products |

1,283,000 |

4.4% |

1,305,000 |

4.3% |

|

Food products |

879,000 |

3.0% |

942,000 |

3.1% |

|

Metal ores |

719,000 |

2.5% |

699,000 |

2.3% |

|

Crude oil |

662,000 |

2.3% |

767,000 |

2.5% |

|

Basic metal products |

457,000 |

1.6% |

52.700 |

0.2% |

|

Glass and stone |

409,000 |

1.4% |

444,000 |

1.4% |

|

Total |

4,623,000 |

100% |

30,663,000 |

100% |

Source: https://www.aar.org/data-center/railroads-states/

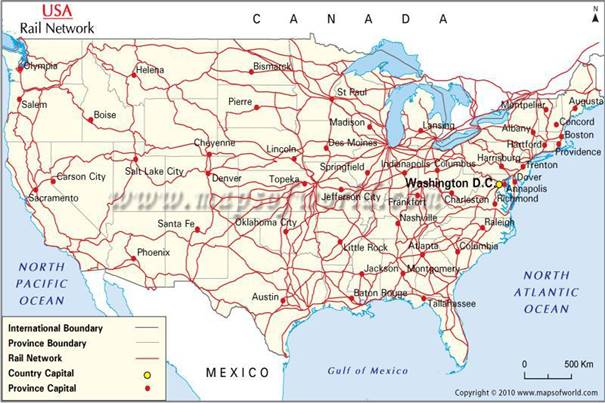

The US intermodal transport system is predominantly based

on strategically located railway terminals (Fig. 9). In the recent years,

railways have invested billions of dollars to build and expand intermodal

terminals and furnish them with the state-of-the-art equipment and

instrumentation, including emission-free electric cranes with GPS units,

capable of moving intermodal containers between trains, heavy vehicles and

ships within minutes, while reducing pollution at the same time. Introducing

optical scanners and automated gantries enable cars to reach railway facilities

faster, thus reducing idle time and increasing safety. The network of

“smart routes” featuring detectors provides real-time feedback on

the condition of the railway infrastructure and equipment. The strategic

locations of these terminals (there are more than 180 intermodal facilities all

over the United States) have made railways highly competitive with regard to

domestic freight services. Intermodal transport currently accounts for ca. 23%

of railways’ total revenue[24].

Fig. 9. Logistic and technical hubs in the US railway

network

Source: https://www.mapsofworld.com/usa/usa-rail-map.html

Since the 1980s, transport of containerised cargo

using the double-stack system has been growing in popularity. In its intermodal form, cargo containers are stacked

on a railway platform, one on top of the other in two layers (Fig. 10).

Using the double-stack solution translates into significantly improved

efficiency of a standard railway set, which is the reason it is used in most

North American railway lines. The requirement

for the deployment of this mode of railway traffic is the redevelopment of many

routes in major lines, including bridges and tunnels, in order to adapt them to

very high loads and dimensions. The double-stack transportation system

currently uses 20’, 40’, 48’ (14.63 m) and 53’ (16.15

m) long containers[25]. They are placed on

pocket-type railway platforms, which reduce vibrations while the train is

running, by their swinging motion, thus protecting the cargo against damage or

opening of the container door. Over the years, lighter and more durable

aluminium structures have been redesigned, including platforms used to

transport coal to power plants, and the traditional timber transport rolling

stock has been upgraded to facilitate loading and unloading.

Fig. 10. Transport of containerised cargo using the

double-stack system

Source:

https://www.sdcexec.com/transportation/news/20986754/us-intermodal-rail-volume-on-recordsetting-track

Certain aspects of the transport of containerised

cargo in the double-stack system have been revolutionised by recent

communication technology. The railway company operating the Union Pacific line

has implemented a computer system enabling direct communication between the

crew and the marketing department, making it possible to report vehicles

approaching the unloading point or returning to the depot in real time. Such a

solution also translates into flexibility in sending service orders to a train

when en route. In Roanoke, Virginia, the huge Norfolk Southern cargo hub is

equipped with a technology enabling remote control of the trans-shipment

process. The computers set the brake lever and braking pressure, and control

the switches on board the vehicles in the sorting plants. The operators working

in a strategically positioned tower can change the frequency at which

locomotives are made ready by adjusting the rate of cars moving through the

service yard[26].

6. SAFETY AND COMPETITIVENESS GROWTH FACTORS

The current federal legislation on

rail transport is largely prescriptive and does not encourage railway

corporations to freely introduce technologies to improve safety and efficiency.

In order to increase railway safety, particularly in light of the growing

number of fatal accidents between 2002 and 2008, the US Congress adopted the

Rail Safety Improvement Act in 2008, introducing new regulations to control the

various spheres related to railway safety, such as hourly requirements towards

railway workers, interoperability of rail transport, track inspection

standards, locomotive certification system and level crossing safety. The very

same year saw the government obligating railway carriers to implement the PTC

(Positive Train Control) system, a modern technology supporting railway traffic

management while providing subsidies from the state budget at the same time (in

2017 only, USD 199 million was allocated for this purpose). The PTC system

enables automatic deceleration of trains or stopping them completely when

facing a high probability of derailment or collision. According to the

applicable laws passed by the Congress and the provisions of the arrangements

with the Association of American Railroads, PTC is currently being tested on 83.2%

of the target railway routes. The system is expected to be fully operational by

31 December 2020. By the end of December 2018, class I railway operators had

invested USD 10.5 billion in the expansion, installation and implementation of

PTC. All lines feature 100% of the necessary technical facilities (roadside

equipment, office facilities, locomotives) and have completed all the necessary

personnel training required by law[27].

According to data concerning railway safety,

between 2008 and 2017, the rate of accidents involving trains dropped by 40%.

These were the safest years in the history of the railway sector. This result

was undoubtedly influenced by the investments made by private operators over

the stated period in the deployment of advanced technologies on railway lines,

averaging more than USD 25 billion per annum[28].

Train accidents caused by the

technical condition of the rolling stock account for 14% of all accidents.

Their number has declined by 16% since 2008. Wagon upgrades, advanced equipment

control technology and company-wide asset management programmes have all

contributed to the improvement of safety, while the human-induced accident

rate, whose share in the total number of rail accidents is typically the

highest (38% in 2017), dropped by 20% since 2008. In order to curb such

incidents, employees are required to participate in mandatory rigorous training

and fatigue management programmes.

Rail freight carriers transport many hazardous

materials. In order to maintain the highest possible safety in transport,

carriers cooperate in this respect with forwarders of hazardous substances,

suppliers of railway lines and the government’s partners in preparing

highly specialised initiatives, regulations and standards. Combined with the

railway sector’s ongoing commitment to infrastructural investments,

technological innovation, rigorous employee training, self-imposed operational

practices and community safety efforts, all these initiatives have made freight

railway lines, the avant-garde of safety improvement endeavours undertaken in

the United States.

Highly specialised IT systems monitor the technical

condition of railway equipment in real time using smart sensors, advanced

analytics software and solutions for sharing data across the entire railway

sector. Detectors installed along railway tracks use a wide array of different

technologies, such as infrared and lasers, to assess the condition of bearings,

axles, wheels and springs as trains travel at speeds of up to 60 MPH.

Specialised software analyses images and warns the railway staff of anomalies

requiring further analysis.

Other technologies used on

the US railways to analyse the technical condition of the track superstructure

include ultrasounds and drones. Similarly, electromagnetic ground-penetrating

radars allow railway workers to detect any abnormalities, such as the presence

of water in the ballast, which may cause degradation of rails, particularly at

welds. Railway operators use these solutions to identify potential problems and

plan maintenance.

7. CONCLUSIONS

The development of the US railways over the recent decades

has been driven by a number of factors, which includes economic progress, the

diversity in the demand of individual regions extending over vast territories

for specific goods, and the dynamic international trade. The economic

attractiveness of railways rests upon the foundation of increasingly

competitive prices, not imposed by any monopolist.

Rail transport plays an important

role in the US economy, particularly in terms of the movement of imported and

exported containerised cargos alongside coal and crude oil supplies. The most

rapidly growing segment of the rail market has recently been the intermodal

transport sector, whose volume has tripled over the last 25 years. The efficiency

of intermodal transport provides the United States with an enormous competitive

advantage in the global economy context.

The progress observed in the rail transit of goods

results from the considerable capital expenditures for investments in and

operation of railway infrastructure and rolling stock. It involves upgrading of

traffic organisation, and application of strict rules concerning the operation

and maintenance of rolling stock and traffic control. Ensuring safe and

efficient operation enables railway operators to maintain their competitive

advantage. Thanks to the use of highly advanced software and state-of-the-art

technologies, rail freight transport has been performing more effectively than

ever.

Since 1980, the density of rail traffic has increased

by about 300% without substantial growth in the railway network size, while the

efficiency of locomotives has increased by 93% and the average cargo

transported per train, by 63%. The improvement in the operating efficiency of

railways is also a source of dividend for rail freight forwarders, and

consequently, helps it maintain prices on a low level. In fact, freight

forwarders can now move around twice as many goods for almost the same price as

in 1980.

Since 2006, the US Congress has

consistently implemented a research and development (R&D) programme by

allocating approximately USD 35 million annually[29]

in various research institutions, universities

and consulting companies, to be utilised for the purposes of research and

development efforts towards addressing current technological challenges tackled

by railways. The methodical approach to the financing activity over the recent

years has allowed the Federal Railroad Administration, the official party in

charge of spending the allocated funds, to build a strong scientific base, a

key important factor to the programme’s success. The stability of

the financing scheme increases the programme’s efficiency making it

possible to run multiannual projects, invest in test facilities and equipment,

such as those used in high-speed intercity passenger trains, in addition to

building and maintaining highly specialised expertise. Universities can develop

educational programmes to provide qualified personnel for the industry and

build partnership with industry stakeholders. However, most importantly, the

regular funding of the research and development activity constitutes a means of

direct support for the efforts aimed at continuous improvement of railway

safety.

References

1. Alfred D. Chandler Jr. 1977. The Visible Hand: The Managerial Revolution

in American Business. The Belknap Press of Harvard University Press

Cambridge, Massachusetts and London, England.

2. Association of American

Railroads. Available at: https://www.aar.org/article/preparing-future-intermodal-freight-rail/.

3. Association of American

Railroads. Available at: https://www.aar.org/data-center/railroads-states/.

4. Association of American

Railroads. Available at: https://www.aar.org/issue/freight-rail-intermodal/.

5. Association of American

Railroads. Available at: https://www.aar.org/railroad-101/.

6. Bureau of Transportation

Statistics. Available at: https://www.bts.gov/.

7. Bureau of Transportation

Statistics. Available at:

https://www.bts.gov/sites/bts.dot.gov/files/docs/browse-statistical-products-and-data/transportation-statistics-annual-reports/215041/tsar-2017-rev-2-5-18-full-layout.pdf.

8. Bureau of Transportation

Statistics. Available at:

https://www.bts.gov/sites/bts.dot.gov/files/docs/bts_program_resources.pdf.

9. CNN Business. Available at:

https://money.cnn.com/2013/01/30/news/economy/gdp-report/index.html.

10. CNN Business. Available at:

https://money.cnn.com/2018/07/25/news/economy/state-of-the-economy-gdp/index.html.

11. CSX Corporation. Available at:

https://www.csx.com.

12. Federal Railroad Administration.

Available at: https://www.fra.dot.gov/.

13. Federal Railroad Administration.

Available at: https://www.fra.dot.gov/Page/P0151.

14. First railway in America Built in

Lewiston. Spring 2010. Available at: http://historiclewiston.org/wp-content/uploads/2016/06//the_cradles_tramway_placemat.pdf.

15. Focus Economist. Available at:

https://www.focus-economics.com/countries/united-states.

16. Available at:

https://inzynieria.com/wpis-branzy/rankingi/10/52442,najwieksze-gospodarki-swiata-2018,pozycja-rankingu-4-niemcy-3-68-bln-usd.

17. Available at:

http://mikes.railhistory.railfan.net/r013.html.

18. European Commission. Available at:

https://ec.europa.eu/poland/events/170608_TTIP_pl.

19. Mindur M. (ed.). 2017. LOGISTYKA Nauka-Badania-Rozwój. [In

Polish: LOGISTICS

Science-Research-Development]. ITE-PIB. 633 p.

20. North American Transportation Statistics

Database 2007-2015. Available at:

http://www.rita.dot.gov/bts/data_and_statistics.

21. RailFreight.com. Available at:

https://www.railfreight.com/railfreight/2019/02/15/almost-all-railways-in-us-operate-positive-train-control/?gdpr=accept.

22. Railway Supple Institute. Available at:

https://www.rsiweb.org/-25sept18.

23. Statista. Available at:

https://www.statista.com/statistics/268173/countries-with-the-largest-gross-domestic-product-gdp/.

24. The World Factbook. Available at:

https://www.cia.gov/library/publications/the-world-factbook/geos/us.html.

25. Tradingeconomist. Available at:

https://tradingeconomics.com/united-states/gdp-from-transport.

26. Trains Magazine, Why no double stacks

outside of North America? Available at:

http://cs.trains.com/trn/f/111/p/204998/2244756.aspx.

27. U.S. Bureau of Economic Analysis.

Available at: https://www.bea.gov/news/glance.

28. US Intermodal Network. Available at:

http://www.worldshipping.org/industry-issues/transportation-infrastructure/u-s-intermodal-network.

29. Available at:

http://www.mapsofworld.com/usa/usa-rail-map.html.

30. Available at:

http://www.sdcexec.com/transportation/news/20986754/us-intermodal-rail-volume-on-recordsetting-track.

31. Vernon, Edward (ed.). Travelers’

Official Railway Guide of the United States and Canada, Philadelphia: The

National General Ticket Agents’ Association. June, 1870, Tables 215 and

216.

Received 03.06.2019; accepted in revised form 29.08.2019

![]()

Scientific

Journal of Silesian University of Technology. Series Transport is licensed

under a Creative Commons Attribution 4.0 International License