Article

citation information:

Balcerzak, T. Global aerospace

industry risks. Scientific Journal of

Silesian University of Technology. Series Transport. 2019, 102, 05-27. ISSN: 0209-3324. DOI: https://doi.org/10.20858/sjsutst.2019.102.1.

Tomasz BALCERZAK[1]

GLOBAL AEROSPACE

INDUSTRY RISKS

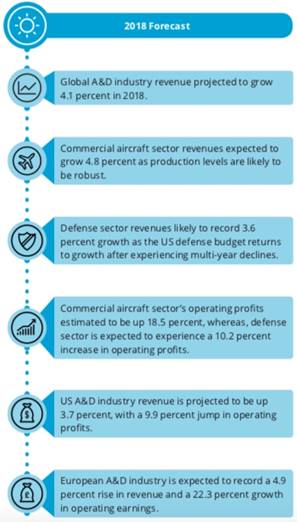

Summary. The

global Aerospace industry is expected to improve in 2018 as its revenue is

predicted to rise by 4.1% , doubling last year’s 2.1% growth. The

recovery of global gross domestic product (GDP), stable commodity prices, and

increased passenger travel demand are likely to ramp up growth in the

commercial aircraft sector in 2018. This article reviews the performance of the

aerospace industry in 2017 and 2018 and speculates its growth in the incoming

years. It also outlines the performance across the major aerospace markets and

discusses trends that will impact the industry. The article forecasts the

mergers and acquisitions activity in 2018 that lays the foundation for further

growth in this space. Key findings are:

• Commercial

aircraft sector revenues are expected to grow by 4.8% as production levels are

likely to be robust while the defence sector revenues are likely to record 3.6%

growth as the US defence budget recovers after experiencing multi-year

declines.

• The spiralling

demand for passenger travel is driving commercial aircraft production and is

responsible for the record high backlog of 14,215 units at the end of 2017.

• In 2018, global

Mergers and Acquisitions (M&A) activity is expected to remain strong in the

aerospace sector, being driven by pricing pressures from aircraft OEMs and

their expansion of high-margin aftermarket services. This has pushed suppliers

to consolidate for scale and cost-effectiveness.

Keywords: aerospace, aerospace risks, aviation

technology, aerospace sector, passenger travel, commercial aircraft, aerospace

forecast

1. INTRODUCTION

After a year of subdued growth in 2017, the global

Aerospace and Defense (A&D) industry is expected to improve in 2018 with

Deloitte[2]

forecasting industry revenues to grow by about 4.1% . The industry closed the

2017 year with 2.1% revenue growth, in line with Deloitte’s forecast of

2.0% (refer to Deloitte’s 2017 Global aerospace and defense industry

outlook).

Recovery in global gross domestic product (GDP)

growth, stable commodity prices including crude oil and growth in passenger

travel demand, especially in the Asia-Pacific, the Middle East, and the Latin

America regions, is likely to drive the commercial aircraft sector growth in

2018. At the end of 2017, commercial aircraft backlog remained at an all-time

high at about 14,000 units, representing nine and a half years of current

annual production rate. Almost a 100 additional aircraft are expected to be

produced in 2018, compared to 2017, aircraft manufacturers ramp up production

in response to growing aircraft demands.

Mergers and Acquisitions (M&A) activity has

accelerated over the past year, with more than a two-fold increase in deal

value. In 2018, the A&D industry is likely to continue to experience

increased M&A globally, driven by original equipment manufacturers’

(OEMs) continued pressure on suppliers to reduce costs and boost production

rates. M&A activity in the US defence sector could accelerate in 2018 as

increased defence budgets are likely to provide certainty to military planners.

Large prime contractors are anticipated to consider acquiring small to

mid-sized companies to gain access to new technologies and markets. The defence

sector in Europe is unlikely to see large M&A deals, however, companies may

pursue Joint-Ventures (JVs) to strengthen their market positions.

With higher production requirements for both aircraft

and defence equipment in the future, it is critical for A&D companies to

invest in new and advanced technologies. This will help the industry to be at

the forefront of manufacturing, hence, enhancing productivity and efficiency.

Fig. 1. Global Aerospace and Defence 2018 forecast.

Source: Deloitte’s 2017 Global aerospace and defense industry outlook

2.

COMMERCIAL AIRCRAFT SECTOR OUTLOOK

The global commercial aircraft sector is projected to

record a 4.8% growth in revenue in 2018. The sector is likely to experience a

stronger growth rate in 2018 after its low performance in 2017, primarily

driven by an increase in production levels as aircraft manufacturers set to

boost production in response to the growing aircraft demand. An estimate of

about a 100 additional commercial aircraft are to be produced in 2018,

primarily led by the narrow body aircraft. Major aircraft manufacturers, Airbus

and Boeing, have indicated that production rates increased in 2018 and 2019,

with the Airbus likely to ramp up production of its A320neo in 2018. Boeing is

expected to increase the production rate of its 737 from 47 per month in 2017

to 52 per month in 2018 and 57 per month in 2019.

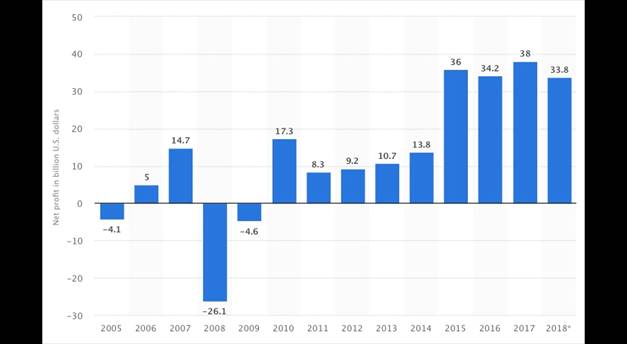

Fig. 2. Net profit of

commercial airlines worldwide from 2005 to 2018

(in billion U.S.

dollars)

Source: The Statistics

Portal https://www.statista.com/register/corporate

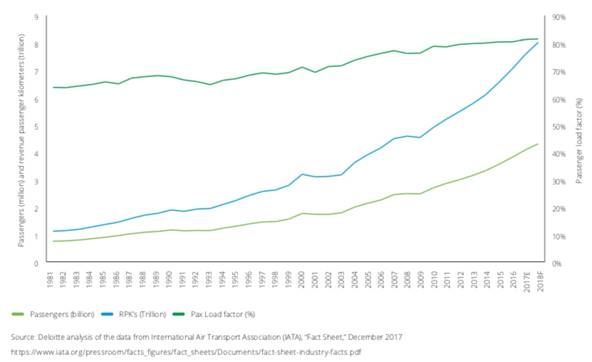

Travel demand (Revenue Passenger Kilometers or RPKs)[3] increased at a CAGR[4] of 5.1 percent over the last 10 years. Annual passenger enplanements rose

from about 2.5 billion in 2008 to more than 4.0 billion in 2017(Figure 2). The

year-on-year increase in 2017 was led by the Asia-Pacific region and is likely

to continue to drive the passenger growth in the long-term due to the

increasing share of the middle class population in the region, forecasted to

grow to 65% by 2030 as compared to 46% in 2015.

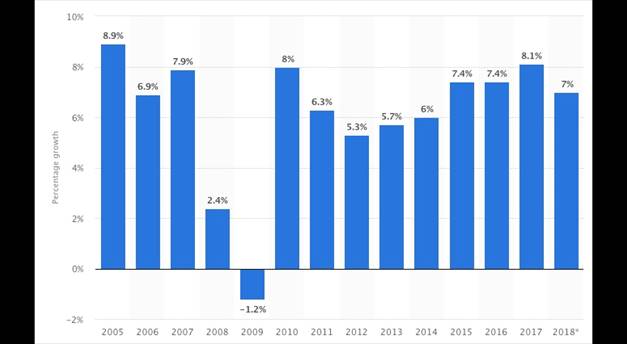

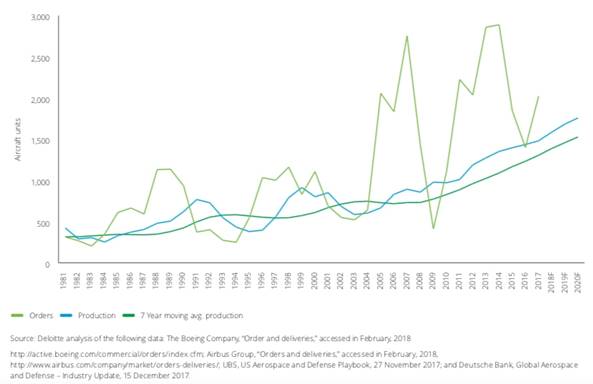

Over the next 20 years, passenger traffic is expected

to grow at an Average Annual Growth Rate (AAGR) of 4.7%, contributing to

increased aircraft production (Figure 3). Strong order intake in the past

several years resulted in a record high commercial aircraft backlog of 14,215

units at the end of 2017, representing nine and a half years of current annual

production.

Fig. 3. Annual growth in

global air traffic passenger demand from 2005 to 2018

Source: The Statistics

Portal https://www.statista.com/register/corporate

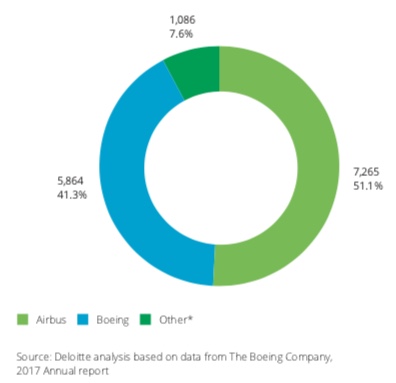

Fig. 4.

Commercial aircraft unit backlog (as of December 2017)

Source:

Deloitte’s 2017 Global aerospace and defence industry outlook

The large commercial aircraft market is a duopoly

market with Boeing and Airbus collectively holding approximately 80% of the

entire market share. Both have aggressively pursued orders with emerging market

airlines and the growing low-cost carrier segments, often with favourable

financing terms. Boeing and Airbus are the only players in the wide-body

segment, while also dominating the narrow-body segment. Other players, such as

the Bombardier and the Embraer, are present in the regional aircraft segment.

The narrow-body aircraft manufacturers also face some competition from

Bombardier’s C-Series and will also have new entrants such as COMAC and

Mitsubishi to contend with. COMAC, in particular, is likely to succeed given

its ability to support a captive domestic market and the Bombardier has secured

investment in C-Series by the province of Quebec in return for equity. However,

in the medium term, opportunities for the new players are likely to be limited

given the dominance and long order books of the Airbus-Boeing duopoly, which has

effectively locked out new entrants.

Consolidation has continued within the fragmented

commercial aerospace supply chain, this is due in part to the support of the

OEMs seeking stronger suppliers with access to capital as partners who can

support and partly fund new programme developments. Larger tier one and tier

two suppliers have increased bargaining power with the OEMs given constrained

production capacity. This has led to expanded margins at these levels at the

expense of the OEMs. It has also driven increased M&A activity and

increased pricing as strategic and private equity groups compete for scarce

assets.

In Maintenance, Repair and Overhaul (MRO)[5] and broader aftermarket, structural headwinds have created challenges. New

sensor technology allows engine OEMs to control timing the of maintenance and

the OEMs have changed their business models toward “through life total

care”, reducing MROs share of spend. Airlines have been more rigorous on

MRO costs. Aftermarket-focused businesses with long-life programmes have seen

traditional high-margin pricing affected by the growth in the surplus parts

market, being aided by the increased supply of parts as older aircraft are on

verge of retirement.

As shown in Figure 5 above, passenger travel demand

increased almost sevenfold from 1981 to 2017, with the passenger load factor

(aircraft utilisation) rising 27.5% (nominally growing from 63.7 to 81.2% )

during the same period. Likewise, the number of people flying per year also

continued to grow, with a greater than five times increase from 1981 to 2017.

This was mainly led by increased affordability of tickets as the average return

fare (adjusted for inflation) of US$355/per passenger in 2017 was 64% lower

than that of 1996 (Figure 6).

Global demand for new aircraft production over the

next 20 years is estimated to be 36,780 aircraft (excluding regional jets).

Figure 4 depicts the sales order and production history of commercial aircraft

from 1981 through 2017, showing a 248.5% increase in production during the period.

On the basis of a seven-year moving average, production levels over the past 20

years have increased by 138.3% and over the next decade, commercial aircraft

annual production is likely to increase by 25.0% .

As aircraft production continues to grow, there are

key challenges the industry needs to consider among other factors;

strengthening the supply chain, effective programme management, and use of new

and advanced technologies to become more efficient (Figures 7 and 8).

Fig. 5.

Global airline traffic (1981 to 2018F)

Source:

Deloitte’s 2017 Global aerospace and defense industry outlook

Fig. 6. The lines

converge. As oil prices rise, the fundamentals begin to converge in 2018

Sources: CAPA –

Centre for Aviation, IATA, oilprice.net, The Economist

Fig. 7. Aircraft

innovations and airline practices have improved fuel efficiency

Source: IATA: http://www.iata.org

Fig. 8.

History and forecast for large commercial aircraft orders and production

(1981 to

2020F)

Source:

Deloitte’s 2017 Global aerospace and defence industry outlook

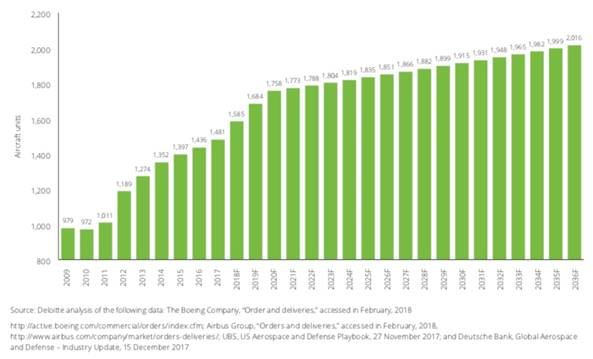

After

experiencing the delivery of 1,481 units, which indicates moderate growth in

2017, it is estimated that 1,585 commercial aircraft will be

produced in 2018, which is a 7.0% increase over 2017, and a 24.4% increase

compared to five years ago. In five years, the sector is expected to produce

1,788 aircraft, a 20.8% increase from 2017. Figure 9 illustrates aircraft

production, indicating the solid growth experienced by the commercial aircraft

sector since 2009.

However, demand for widebody aircraft is expected to

soften due to overcapacity in the industry, airlines deferring upgrades as they

wait for the super-efficient next-generation widebodies, as well as the robust

order backlog of widebodies. Moreover, with oil prices stabilising at

low-to-mid levels, older aircraft have become more economical, potentially

making new widebodies less attractive.

Fig. 9.

Aircraft deliveries (2009 to 2036F)

Source:

Deloitte’s 2017 Global aerospace and defence industry outlook

As the demand for commercial aircraft continues to

increase, new production programmes are emerging from other regions,

particularly China and Russia. With 815 orders from 28 customers for Commercial

Aircraft Corporation of China’s (COMACs) C919 aircraft programme, China

is observing some success with respect to its domestically manufactured

commercial aircraft, whose deliveries are likely to commence in 2021. Given the

fact that majority of its customers are Chinese airlines and leasing companies,

COMAC also plans to increase its focus on potential buyers in Africa, Middle

Asia, and West Asia.

Nevertheless, to compete with the existing duopoly,

these new entrants will face several challenges, ranging from procurement of orders

from established global carriers, risk of cost and schedule over-runs,

certifications from European and US regulators, to establishing a track record

of safe and reliable operations.

3. OUTLOOK FOR AEROSPACE ACTIVITY IN 2018.

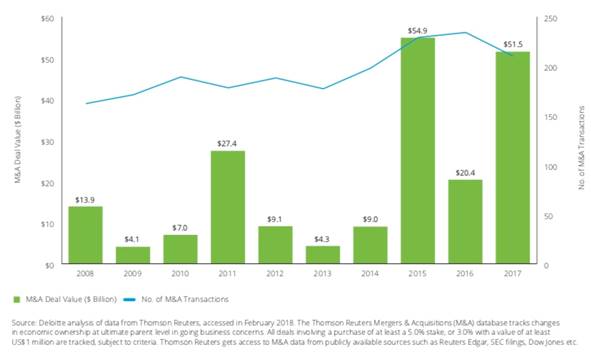

M&A deal value in the global A&D industry

reached US$51.5 billion in 2017, with the number of transactions down to 210,

compared to 234 transactions in 2016. Value of M&A transactions in 2017 was

close to the record high levels of 2015, primarily led by the mega-deal of

Rockwell Collins’s US$30.2 billion acquisition by United Technologies

Corp. In 2015, M&A deal value peaked, however, this was heavily weighted by

one transaction, the Berkshire Hathaway Inc.’s US$35.8 billion

acquisition of Precision Castparts Corp.

Pricing pressures from aircraft OEMs and their

expansion of high-margin aftermarket services have pushed suppliers to

consolidate for scale and cost-effectiveness. For example, aerospace supplier

United Technologies Corp. agreed to acquire avionics and interiors maker Rockwell

Collins, Inc. for US$30.2 billion to increase its negotiating power with

aircraft manufacturers. Efforts to rebuild missile defence systems,

geopolitical tensions and the US administration’s rising defence budget

drove deal-making in the defence sector in the US. Notable deals include

Northrop Grumman Corp.’s US$7.8 billion deal to acquire fellow defence

contractor Orbital ATK, Inc. The deal is expected to provide Northrop Grumman

with greater access to government contracts and expand its arsenal of missile

defence systems and space launch systems (Figure 10).

Fig. 10. Global

aerospace and defence industry mergers and acquisition activity

(2008 to 2017)

Source: Deloitte’s

2017 Global aerospace and defence industry outlook

In 2018, the global M&A activity is expected to

remain strong in the aerospace sector, driven by OEMs’ continued pressure

on suppliers to reduce costs and boost production rates. In addition, the

Northrop Grumman and Orbital ATK deal could prompt other defence contractors to

broaden their offerings and increase negotiating leverage through acquisitions.

Deal activity in the US defence sector could accelerate in 2018, as the

DoD’s[6] spending bill will likely provide certainty to military planners. Large

prime contractors are expected to buy small to mid-sized companies to gain

access to new technologies or certain markets. In Europe, the defence sector is

not likely to observe large deals, however, companies may choose to pursue JVs

to bolster their market positions. The focus is probably on acquisitions

related to space, data analytics, cybersecurity, and advanced technologies.

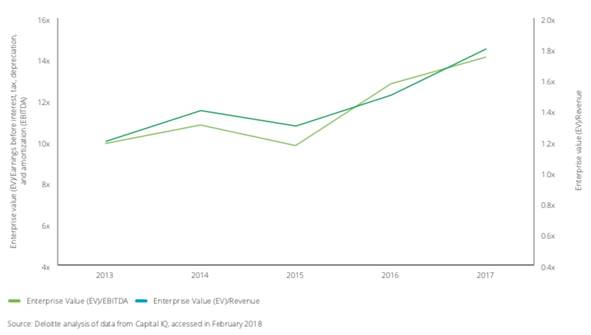

Valuations of A&D companies have been on the rise,

led by continued improvements in financial performance and growth expectations.

Specifically, the price earnings (P/E) ratio[7] of the A&D industry is now 30.0% higher than it was five years ago.

Figure 11 shows the increase in enterprise value on both earnings before

interest, tax, depreciation, and amortization (EBITDA)[8] and revenue basis.

Fig. 11. Global A&D

industry valuations (2013 to 2017)

Source: Deloitte’s

2017 Global aerospace and defense industry outlook

A&D companies are also entering into cross-border

JVs, which remains an important determinant in expanding international access

to new markets and technology. Cross-border JVs create a new third entity that

combines certain assets of the two partners while maintaining the ownership

profile of the original entities. As compared to M&A, JVs are easily

achievable because the risk is shared between both JV partners and the outlay

of investment is less than an outright acquisition. Changes in regulations,

access to new technologies, the need for local partners, and a fast-growing

A&D industrial base are likely to make India and the Middle East “hot

spots” for cross-border JVs in the near-term for both commercial aircraft

and defence sectors. China is also expected to be an important destination for

JVs in the commercial aircraft and equipment space.

4. GLOBAL AEROSPACE

INDUSTRY SHAREHOLDER RETURNS PERFORMANCE.

The key A&D industry indices (including the

US-based S&P[9] A&D[10] Select Index and the European STOXX[11] Europe Total Market A&D Index) continued to outperform the broader

market indices. Driven primarily by higher profitability, free cash flow, return

on invested capital, and future growth expectations, the S&P A&D select

index experienced a 402% improvement over the past 12 years, compared to a 115%

improvement for the S&P 500 Index. Additionally, share buyback programmes

by A&D companies have also contributed to the solid growth in their stock

prices in the recent past. Figure 12 portrays the performance of the industry

indices in comparison with the broader market indices.

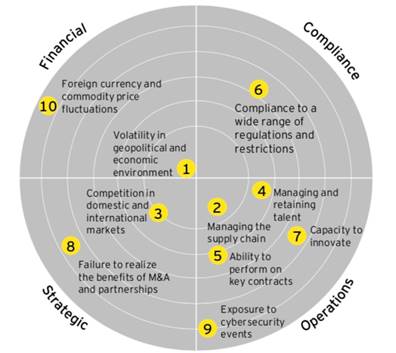

Main global aerospace and defence risks area are

(Figure 13):

·

Compliance threats originating in politics, law, regulation or corporate

governance.

·

Operational threats impacting the processes, systems, people and overall

value chain of a business.

·

Strategic threats related to customers, competitors and investors.

·

Financial threats stemming from volatility in the markets and in the

real economy.

Fig. 12.

Global A&D industry indices’ performance (2006 to 2018YTD)

Source:

Deloitte’s 2017 Global aerospace and defense industry outlook

Fig. 13.

Global A&D industry risks. Top 10 risks in aerospace and defense (A&D) - Ernst & Young-EY[12],

Report 2017

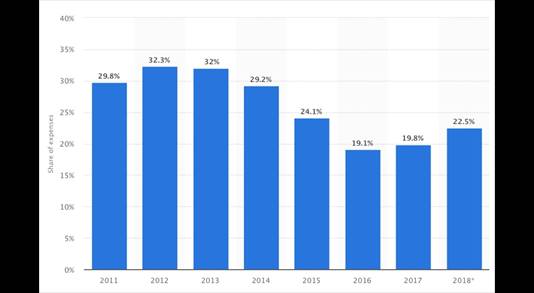

Fig. 14. Fuel costs of

airlines worldwide from 2011 to 2018, as percentage of expenditure

Source: The Statistics

Portal https://www.statista.com/register/corporate

Top aerospace and defence risks are:

1. Volatility in geopolitical and

economic environments (Figure 14).

2. Managing the supply chain.

3. Competition in domestic and

international markets.

4. Managing and retaining talent.

5. Ability to perform on key

contracts.

6. Compliance to a wide range of

regulations and restrictions.

7. Capacity to innovate.

8. Failure to realise the benefits

of M&As and partnerships.

9. Exposure to cybersecurity

events.

10. Foreign currency and

commodity price fluctuations.

5. MANAGING AND RETAINING TALENT

A highly engaged talented workforce can give companies

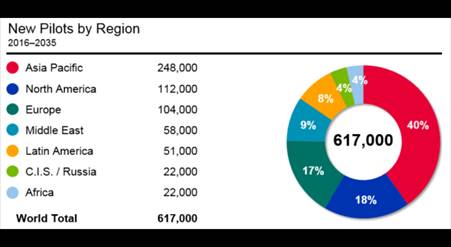

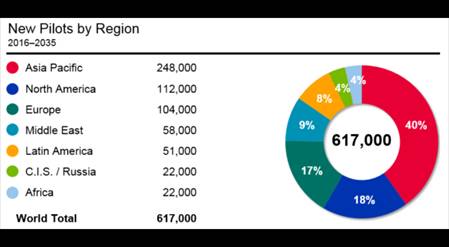

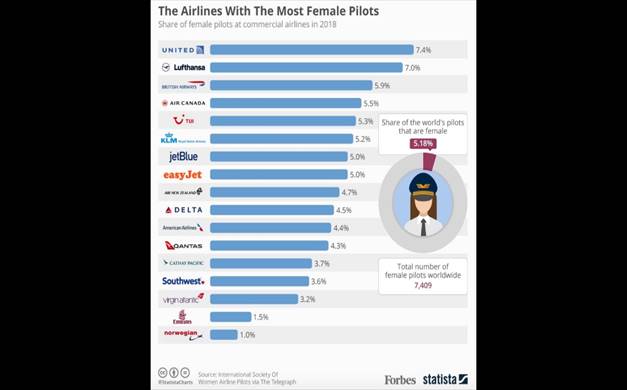

the edge in the marketplace (Figure 15, Figure 16, and Figure 17).

Because of the specialised nature of the business,

companies are highly dependent on the continued services of key engineering

personnel and executive officers. They are also dependent on the development of

additional management personnel and the hiring of newly qualified engineering,

manufacturing, marketing, sales and management personnel for operations.

Fig. 15. Boeing foresees

a big need for new pilots in the next 20 years

Source: https://www.boeing.com

Fig. 16. Boeing Cabin

Crew forecast

Source: https://www.boeing.com

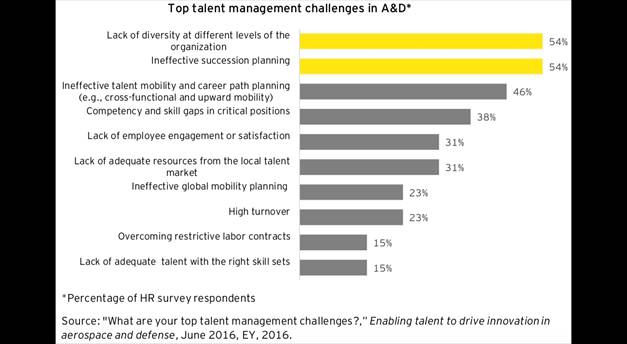

EY conducted a survey to identify the major challenges

faced by A&D companies around talent management. Respondents identified

ineffective succession planning, and lack of diversity as key areas of

opportunity for improvement. A list of the top talent management challenges

faced by A&D companies is given below (Figure 18).

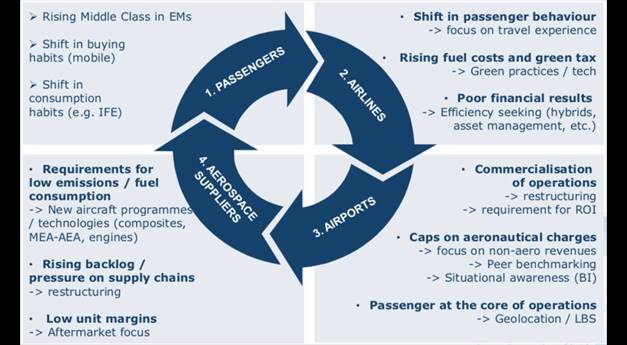

The products and services provided by A&D players

involve sophisticated technologies and engineering, alongside complex

manufacturing and system integration processes (Figure 19).

Fig. 17. Major airlines

with the most female pilots

Source: http://www.iswap.org

Fig. 18. Top talent

management challenges in Aerospace and Defence

Source: Ernst &

Young-EY, Report 2016

Fig. 19.

Forecast for US commercial MRO maintenance technician demand and supply by year

Source:

Frost and Sullivan Report 2018

Because of the highly specialised nature of the

business, companies must hire and retain skilled and qualified personnel

necessary to perform the business-critical processes. In addition, certain

personnel may be required to receive security clearance and substantial

training in order to work on certain programmes or perform certain tasks.

Companies need to manage leadership development and

succession planning in their business. While most of the companies have

processes in place for management transition and transfer of knowledge, the

loss of key personnel, coupled with an inability to adequately train other personnel,

hire new personnel or transfer knowledge, could significantly impact negatively

on their ability to perform under their contracts. On the other hand, as

A&D players expand their operations internationally, it becomes

increasingly important to hire and retain personnel with relevant experience in

local laws, regulations, traditions and business practices. Inability to

attract and retain qualified personnel, and maintain a diversified workforce at

different levels of the organisation might lead to materially adverse effect on

revenue and earnings. Additionally, the average workforce demographic continues

to shift toward a higher proportion of employees nearing retirement.

Considering the fact that companies lose experienced personnel, it becomes imperative

that they develop other employees, hire new qualified personnel, and

successfully manage the transfer of critical knowledge.

Competition for skilled personnel is intense, and

companies are subject to the risk of not being able to hire or retain personnel

with the requisite skills or clearances. A&D companies have to increasingly

compete with commercial technology companies outside the industry for qualified

technical, cyber and scientific positions as the number of qualified engineers

is decreasing and the number of cyber professionals is not meeting demand. As

commercial technology companies grow at a faster rate or face fewer cost and

product pricing constraints, they may be able to offer more attractive

compensation and other benefits to the candidates. At the point where demand

for skilled personnel exceeds supply, A&D companies could experience higher

labour, recruiting or training costs in order to attract and retain skilled

employees. However, would they be unable to hire or retain talent, then they

may experience difficulty in performing key contracts. Furthermore, at

difficult times, endeavours to increase operational efficiency through

workforce reductions, and consolidating and relocating certain operations may

challenge the companies’ ability to retain talent.

Fig. 20.

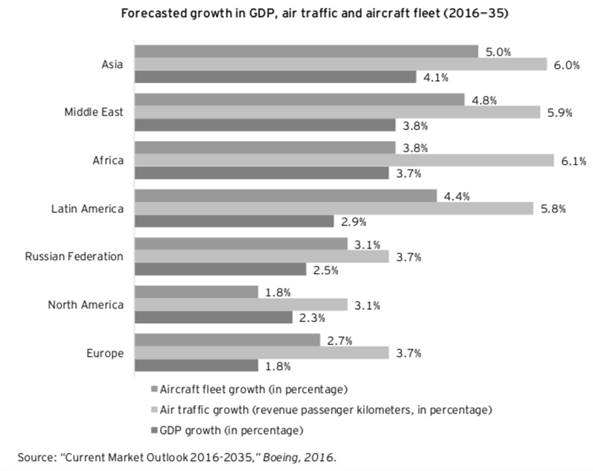

Volatility in the geopolitical and economic environment. Forecasted growth in

GDP air traffic and aircraft fleet (2016-2035). Top 10 risks in aerospace and

defense (A&D)- Ernst & Young-EY, Report 2017

Most A&D companies have global footprints, so

their operational, as well as financial performance, depend significantly on

the geopolitical and economic conditions in their key markets. On the side of

the commercial aerospace, sustained economic growth and political stability are

major underlying factors that drive long-term growth in the air traffic. On the

defence side, political and economic conditions of the developed, as well as

emerging countries, play an instrumental role in dictating the

governments’ allocation of funds for the military.

In recent years, the European financial markets have

undergone significant disruptions due to concerns regarding the ability of

certain countries in the eurozone to reduce their budget deficits and refinance

or repay their sovereign debt obligations. On the other side of the globe,

China has reduced its GDP growth target, indicating apprehensions of a slowdown

of the world’s largest growing economy.

History has over time shown a great correlation

between economic growth and growth in demand for commercial aircraft. The chart

below highlights the expected growth in GDP, air traffic and aircraft fleet

size across different geographic regions.

The chart (Figure 20), clearly shows that Asia and the

Middle East are expected to witness the highest economic growth in the next two

decades. In line with the GDP growth in these regions, air traffic and aircraft

fleet size are also expected to grow significantly during the same period. On

the other hand, aircraft fleet growth as well growth in air travel would

develop at a slow rate in North America and Europe, as the economic growth in

both of these regions is expected to be low at close to 2% per annum.

In the last five years, there has been much volatility

in the GDP growth of the top five defence markets. Over the next five years,

while the GDP of seven of the top 10 defence markets (the US, France, Japan,

the UK, Korea, Russia and Germany) are expected to remain near-stagnant,

China’s GDP growth rate is expected to decline and India and Saudi Arabia’s

GDPs are expected to increase.

6. COMPLIANCE TO A WIDE RANGE OF REGULATIONS AND

RESTRICTIONS

Companies have to comply with the laws and regulations

related to the award, administration and performance of contracts, especially

for government contracts. They face various laws and regulations relating to

the export of products and services as well as the use of technology. Failure

to comply with any of the regulations could result to severe consequences, such

as the imposition of fines and penalties, termination of contracts, suspension

or debarment from bidding on or being awarded government contracts, and civil

or criminal investigations or proceedings.

With the inclusion of government customers and defence

agencies in the customer base of A&D companies, it becomes obvious that

they have to operate in a highly regulated environment. This subjects A&D

companies to added scrutiny on bribery and corruption . Furthermore, A&D

companies often work in partnerships in a number of small and non-consolidated

entities. These entities have a lower level of control and oversight from their

parent groups and presents a higher risk of fraud and corruption. Operating in

countries with high level of corruption often multiplies the level of exposure

to bribery and corruption litigations. Involvement in bribery or corrupt

practices may lead to severe consequences, such as order cancellations or even

blacklisting. For instance, a leading European defence company was blacklisted

by the Government of India on the instance of alleged corruption charges

related to a helicopter acquisition programme.

7. CAPACITY TO INNOVATE

Offerings in the A&D industry involve high-end

technologies and engineering, as well as complex manufacturing and system

integration processes. The demand from the end users is evolving and changing

regularly. To strive in the current era of rapidly evolving technologies across

industries, A&D companies need to constantly focus on innovations in their

product and services offerings. It is also very important for A&D players

to create the right infrastructure for fostering innovation through funding

in-house R&D, collaborating with industry partners and teaming up with the

academia.

Some of the technologies that A&D players use in

their manufacturing and other business processes are decades old. They need to

upgrade these technologies on a regular basis as well as adopt new and advanced

technologies to stay competitive. The advancements in the internet of things

and digital technologies make it even more important for aircraft manufacturers

and their suppliers to look for opportunities to offer new products and

services in both the original equipment (OE) and aftermarket spheres of their

businesses. While OEMs are using digital technologies to improve the performance

and efficiency of their aircraft and parts, aftermarket service providers are

extensively using sensors to capture in-flight data to facilitate predictive

maintenance and associated services.

8. EXPOSURE TO CYBERSECURITY EVENTS.

A&D players transfer large volume of data

including flight data monitoring, flight operations quality assurance and load

management between end users, manufacturer and service provider. Companies

involved in the A&D value chain routinely exchange confidential data on

specifications, technology and performance of equipment or services with the

objective of enhancing collaboration on design, development and support. All of

such data is valuable for cyber terrorists with unethical clients in the

industry, who use this stolen data to copy products and undercut prices to

outperform the competition.

In commercial aerospace, key aircraft functions, such

as flight navigation and control, propulsion, landing and braking, and

information systems, are managed by embedded electronic systems and

safety-critical software. The critical data generated during the time of the

flight is analysed for better flight safety and optimisation. On the defence

side of the business, upgrading of existing weapons, as well as increased focus

on intelligence, surveillance, and reconnaissance (ISR) systems, have increased

the information flow within the supply chain. Furthermore, the confidential and

sensitive nature of the information around programme specifications and

technologies involved necessitates the use of reliable and enhanced

cybersecurity solutions.

Modern-day increased dependency on internet network by

military organisations has brought about the frequency and rise of

sophisticated and organised cyber attacks. Furthermore, the traditional methods

of defences against cyber threats have become ineffective against new types of

cyber attacks and advanced malware. Companies need to invest in the next

generation cybersecurity solutions to be able to prevent themselves against

advanced cyber attacks.

9. FOREIGN CURRENCY AND COMMODITY PRICE FLUCTUATIONS.

Operating in a number of countries across continents,

A&D companies are susceptible to fluctuations in foreign currency exchange

rates. The following chart highlights the fluctuations in the yearly growth

rate of the average value of major currencies against the US dollar in the last

five years.

Given that most of the A&D companies have global

footprints, they earn a significant portion of their revenues in currencies

other than the currency of their home market. With foreign currency

fluctuations, the value of the revenues earned in foreign currencies

fluctuates. The impact of the currency rate fluctuations on the overall

financials of a company is even more magnified when a significant portion of

its revenue comes in foreign currencies.

In addition to its effect on the revenues earned,

currency fluctuations also affect the receivables, payables and return on

assets denominated in foreign currencies. Moreover, production in various

countries adds to the risks associated with fluctuations in the foreign

exchange rate as compared with the home currency.

10. CONCLUSIONS

Companies must prepare themselves to counter the

threat of a tight credit environment and order cancellations. An economic

slowdown in any of the key markets for A&D players could potentially result

into tightening in the credit markets, low liquidity, and extreme volatility in

credit, currency, commodity and equity markets (Figure 21).

Fig. 21. Major Trends in

Commercial Aviation Segments

Source: Frost and Sullivan Report 2018

Customers might review their order intake strategies

and eventually postpone or cancel existing orders for aircraft. In face of the

declining financial health of their customers, A&D companies would need to

provide increased sales financing to the customers to support their purchases,

therefore, increasing its exposure to the risk of customer defaults.

After reaching a peak in 2015, order intake for

commercial aircraft is expected to gradually drop over the next few years.

Airbus's net orders for new aircraft declined by 32% in 2016 (731 in 2016

compared to 1,080 in 2015), while Boeing's net orders declined by 13% (668 in

2016 as compared to 768 in 2015). Order intake in the first two months of the

full year-FY17 has further slowed down. While this is not a problem given the

order books, it suggests growth will flatten once production has ramped.

Furthermore, reductions in public spending for

defence, homeland security and space activities could also result in loss of

sales. In addition, changes in the economic environment and a reduction in

defence budgets may adversely affect the financial stability of the key

suppliers and their ability to meet their performance requirements, impacting

the ability of the OEMs to meet their customer obligations.

References

1.

Airbus 2016 annual report.

2.

Airbus 2017 annual report.

3.

Airbus achieves targets proving ramp-up readiness in 2016. Airbus

website. Available at:

http://airbus.com/presscentre/pressreleases/pressrelease-detail/detail/airbus-achieves-targetsproving-ramp-up-readiness-in-2016/.

4.

Airbus approved supplier list. Airbus website. Available at:

http://airbus.com/fileadmin/media_gallery/files/suppl

y_world/Airbus-Approved-Suppliers-ListJul2016.pdf.

5.

Boeing 2016 annual report.

6.

Boeing 2017 annual report.

7.

Bombardier 2015 financial report.

8.

Bombardier 2016 financial report.

9.

CAPA. “LCCs reach 10% market share in domestic Japan. Partnerships

become likely - but complex”. July 2017. Available at:

http://centreforaviation.com/insights/analysis/lccs-reach-10-market-share-in-domestic-japan-partnerships-become-likely---butcomplex-351499.

10. Current Market Outlook

2016-2035. Boeing website. Available at:

http://boeing.com/resources/boeingdotcom/

commercial/about-ourmarket/assets/downloads/cmo_print_2016_fin al_updated.pdf.

11. Deloitte analysis based

on data from Boeing – available at:

http://http://www.boeing.com/commercial. Airbus – available at:

http://http://www.airbus.com/company/market/orders-deliveries/. Bombardier –

available at: http://http://www.bombardier.com/en/media/commercial-aircraft-status-reports.html.

Flightglobal – available at: http://https://www.flightglobal.com/.

12. Deloitte analysis of

data from Stockholm International Peace Research Institute (SIPRI) Military

Expenditure Database. Available at: http://https://www.sipri.org/databases/milex.

13. Deloitte analysis of the

following data: The Boeing Company. Current Market Outlook (2017–2036),

July 2017. Available at: http://www.boeing.com/commercial/market/current-market-outlook-2017/.

14. Enabling talent to drive

innovation in A&D. EY website. Available at:

http://ey.com/Publication/vwLUAssets/EYenabling-talent-in-aerospace-anddefense/$FILE/EY-enabling-talent-in-aerospaceand-defense.pdf.

15. Global Market Forecast

– Mapping demand 2016/2035. Airbus website. Available at:

http://airbus.com/company/market/globalmarket-forecast-2016-2035/.

16. IATA. Industry

Statistics. December 2017. Available at:

http://www.iata.org/pressroom/facts_figures/fact_sheets/Documents/fact-sheet-industry-facts.pdf.

17. Jacyna-Golda I., M.

Wasiak, M. Izdebski et al. 2016. “The

Evaluation of the efficiency of supply chain configuration”. 20th

International Scientific Conference on Transport Means. Juodkrante, Lithuania.

October 05-07, 2016. Proceedings of the

20th International Scientific Conference Transport Means 2016. Transport Means - Proceedings of the

International Conference. P. 953-957.

18. Kowalski M. 2012. “Phase mapping in the diagnosing of a turbojet engine”. Journal

of Theoretical and Applied Mechanics 50(4): 913-921.

19. Kozakiewicz A., M. Kowalski. 2013. “Unstable operation of the turbine aircraft engine”. Journal of Theoretical and Applied Mechanics

51(3): 719-727.

20. Orders & Deliveries.

Airbus website. Available at:

http://airbus.com/company/market/ordersdeliveries/.

21. Orders and deliveries.

Boeing website. Available at: http://boeing.com/commercial/#/orders-deliveries.

22. Zieja M., P. Golda, M.

Zokowski et al. 2017. „Vibroacoustic

technique for the fault diagnosis in a gear transmission of a military

helicopter”. Journal of Vibroengineering 19(2): 1039-1049.

Received 09.11.2018; accepted in revised form 11.01.2019

![]()

Scientific

Journal of Silesian University of Technology. Series Transport is licensed

under a Creative Commons Attribution 4.0 International License